The current coronavirus pandemic has shed a light on an inconvenient truth. We have become over-reliant on foreign (and especially Chinese) raw materials. As we previously outlined, “PPE has become the poster child, but whether it’s smart phone technology, solar panels, electric vehicles, or fighter jets — critical minerals are integrated into all aspects of U.S. supply chains — and, in spite of the fact that the United States is rich in mineral resources, we have maneuvered ourselves into a situation where we often find ourselves at the mercy of China.”

It’s no secret that China is less friend than foe, and has a history of playing politics when holding leverage over its adversaries.

With COVID-19, the chickens are coming home to roost.

In a new piece for Foreign Policy, Jacob Helberg, senior advisor at the Stanford University Program on Geopolitics and Technology, an adjunct fellow at the Center for Strategic and International Studies, outlines how “China’s recent weaponization of supply chains and information networks exposes the grave dangers of the American deindustrialization that Jobs accepted as inevitable.”

He writes:

“Since March alone, China has threatened to withhold medical equipment from the United States and Europe during the coronavirus pandemic; launched the biggest cyberattack against Australia in the country’s history; hacked U.S. firms to acquire secrets related to the coronavirus vaccine; and engaged in massive disinformation campaigns on a global scale. China even hacked the Vatican. These incidents reflect the power China wields through its control of supply chains and information hardware. They show the peril of ceding control of vast swaths of the world’s manufacturing to a regime that builds at home, and exports abroad, a model of governance that is fundamentally in conflict with American values and democracies everywhere. And they pale in comparison to what China will have the capacity to do as its confrontation with the United States sharpens.”

Warning that “[n]eglecting to quickly safeguard the access and integrity of American supply chains and information networks in the face of successive warnings would be a costly strategic mistake and a blow to U.S. national sovereignty,” Helberg makes the case for a U.S. domestic reindustrialization.

He argues:

“In this new cold war, a deindustrialized United States is a disarmed United States—a country that is precariously vulnerable to coercion, espionage, and foreign interference. Preserving American preeminence will require reconstituting a national manufacturing arrangement that is both safe and reliable—particularly in critical high-tech sectors. If the United States is to secure its supply chains and information networks against Chinese attacks, it needs to reindustrialize. The question today is not whether America’s manufacturing jobs can return, but whether America can afford not to bring them back.”

As ARPN’s Daniel McGroarty recently pointed out, the first word in “supply chain” is “supply” – and, as followers of ARPN know, the vulnerability issue on the front end of our mineral resource supply chains in particular is largely homegrown:

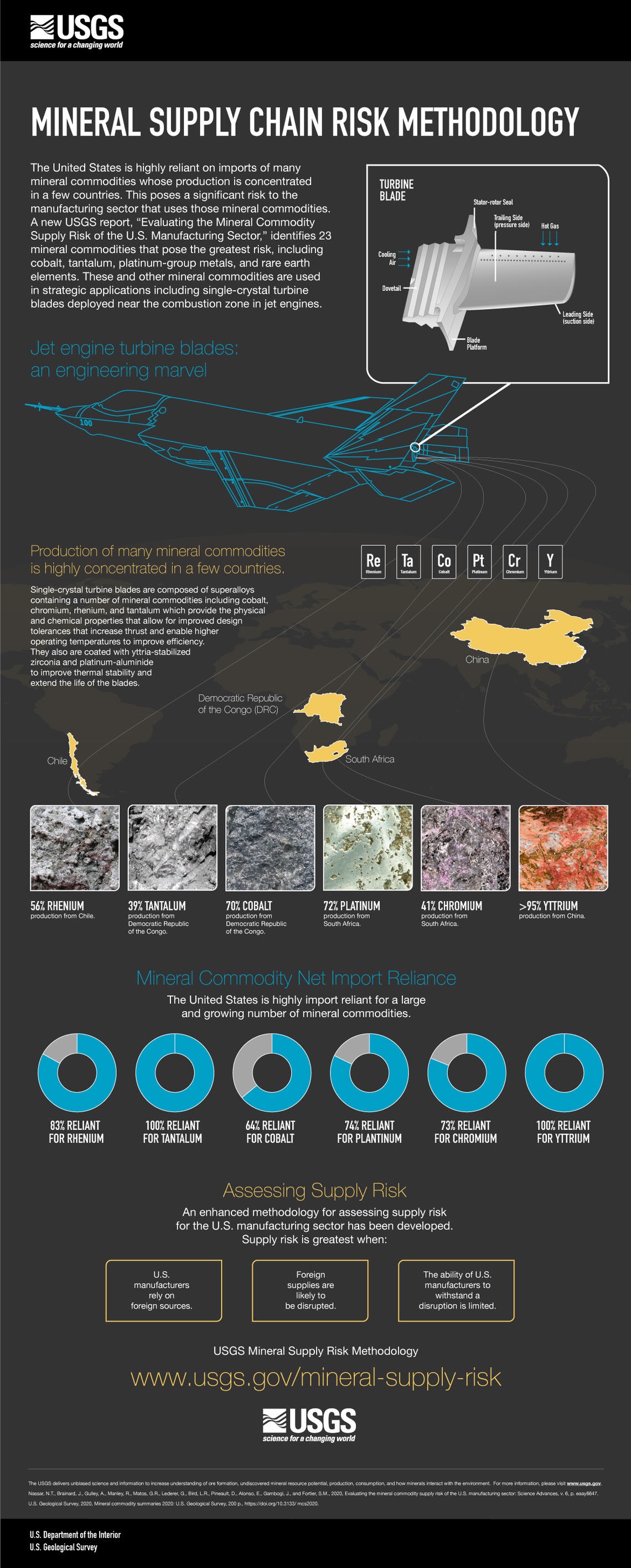

U.S. reliance on foreign non-fuel minerals has significantly increased over the course of the past 65 years, both in terms of number and type, as well as as a percentage of import reliance. Along with the rise in import dependency came a drastic shift in provider countries.

Whereas the number of non-fuel mineral commodities for which the United States was greater than 50% net import-dependent was 28 in 1954, this number increased to 47 in 2014. And while the U.S. was 100% net import reliant for 8 of the non-fuel commodities analyzed in 1954, this total import reliance increased to 11 non-fuel minerals in 1984, and currently stands at 17. In the latest USGS Mineral Commodity Summaries report, China continues to be the elephant in the data room, and is listed 25 times as one of the major import sources of metals and minerals for which our net import reliance is 50% or greater.

As such, it has been encouraging to see that in the wake of the above-referenced developments, U.S. policymakers on Capitol Hill, in the Cabinet Departments and at the White House have begun to strategic materials and critical minerals issues with a new seriousness.

Reform-minded lawmakers have put forth several legislative initiatives, and have even formed a bipartisan “Critical Materials Caucus.” However, while critical minerals provisions were added to the latest round of COVID relief stimulus packages, chances of their passage have been dwindling as partisan tensions continue to flare.

Opponents of comprehensive reform and increased domestic mining tend to argue that trade with allied partners, as well as mitigation strategies like recycling and reuse obviate the need for domestic mining. However, they fail to account for new estimations that material supply pressures will increase dramatically in the coming years in the context of a low-carbon transition. Earlier this year, the World Bank released a study estimating that that production of metals and minerals like graphite, lithium and cobalt will have to increase by nearly 500 percent by 2050 to meet global demand for renewable energy technology. And just last week, Nedal Nassar, chief of the Materials Flow Analysis Section at the National Minerals Information Center, U.S. Geological Survey stressed in a Mining and Metallurgical Society of America webinar that “a combination of trends and issues raise concerns regarding the reliability of supply for certain non-fuel mineral commodities.”

Of course, recycling and reuse, as well as increased cooperation with our close allies to secure critical materials supply are important strategies as we strive to address our supply chain vulnerabilities for a post-COVID context — and it is encouraging to see that progress is being made here. [see our blog for examples of research breakthroughs, successful public-private partnerships, and updates on partnership agreements with allied nations.]

The scope of the mineral resource supply challenge, however, warrants an “all-of-the-above” approach we have come to know from the energy policy discourse. As ARPN’s McGroarty outlined in a panel discussion last year, in the context of working toward “resource independence” that means a focus on new mining, recycling and reclamation of new minerals from old mine tailings, as well as leveraging cooperative agreements with allied nations.

And China’s recent actions outlined by Helberg show that the time to act is now.