This is the second of a two-part post by American Resources Expert Simon Moores and his Industrial Minerals colleague, Andy Miller. Read Part One here.

2013 rebound after poor year

2012 has been a poor year for graphite demand. Trading activity has been sapped out of the industry since September with little sign of return until the New Year.

The conference heard that Chinese production is predicted to have fallen by around 4% in 2012 primarily due to slowing construction markets around the world and a reduction in the need for steel and refractories.

China is also pushing to regulate its graphite industry – a dated and fragmented industry – with a blanket ban on new graphite processing plants in Shandong, a major producing province.

The Chinese government is eager to limit lower value exports in favour of higher value products. In the context of graphite, at present it ships raw material to Japan or South Korea to be made into battery anodes and batteries which it buys back and a premium rate.

This situation strengthens the argument for new mines outside of China and supply diversity is high on the agenda for the graphite industry.

These factors alongside an anticipated rise in demand have encouraged market entry, however Stephen Riddle, CEO of Asbury Carbons, has urged the industry to learn from the mistakes of its past and avoid flooding the market with supply.

This was seen in the early 1990s, when a string of new graphite mines went into production before promptly going out of business due the emergence of low cost Chinese production and shortfalls in anticipated demand. This caused production to nearly half between 1990 and 1995, and by the early 2000s all but one of five new mines went bankrupt.

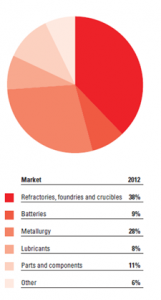

Natural Graphite end markets in 2012

Source: The Natural Graphite Report 2012, Industrial Minerals Research

Industrial Minerals Data

Industrial Minerals Data is a new service providing detailed prices and analysis the graphite and fluorspar industries launching January 2012.

Simon Moores, Manager, Industrial Minerals Data – smoores@indmin.com

Andy Miller, Junior Analyst, Industrial Minerals Data – amiller@indmin.com

The Natural Graphite Report 2012

Launched in October 2012, The Natural Graphite Report is an extensive market study focusing solely on natural flake, vein and amorphous graphite supply, demand and pricing.

Data, analysis and forecast for the next five years

- New, original data from Industrial Minerals

- Unique country supply reviews including: China, Brazil, India, North Korea, and Canada

- Major demand drivers – Li-ion batteries, refractories, & emerging markets

- How will prices react? Historical analysis and forecast

- Demand destruction risks

- Critique of the graphene revolution

For more information click here.