Only weeks before a planned November summit between Chinese President Xi Jinping and his U.S. counterpart, U.S. President Joe Biden, China’s commerce department has announced a new set of critical mineral export restrictions against what Nikkei Asia refers to as “a backdrop of domestic calls for a response to stricter limits on U.S. semiconductor exports to China.”

According to Nikkei, as part of the new restrictions, which will be in place until the end of October of 2025, the commerce department has added rare earths, including compounds and alloys to its “list of mineral resources and other items requiring disclosure of information such as material type and export destinations.”

The move ties into an overall context of export controls are gaining in popularity as the global race for resources heats up. India joined the ranks of countries considering export restrictions this August, and Kenya made similar headlines in October. Zimbabwe banned lithium ore exports last December, and Namibia recently banned the export of unprocessed lithium and other critical minerals.

All these announcement tie into a larger trend, which has been noticeable particularly in Latin America, a region with a historic penchant for nationalism, but also elsewhere. ARPN has featured recent nationalist moves in Chile, Mexico and Bolivia, as well as in Myanmar, Indonesia, and China, and has showcased that even in the Western world, government involvement in the critical minerals sector is on the rise.

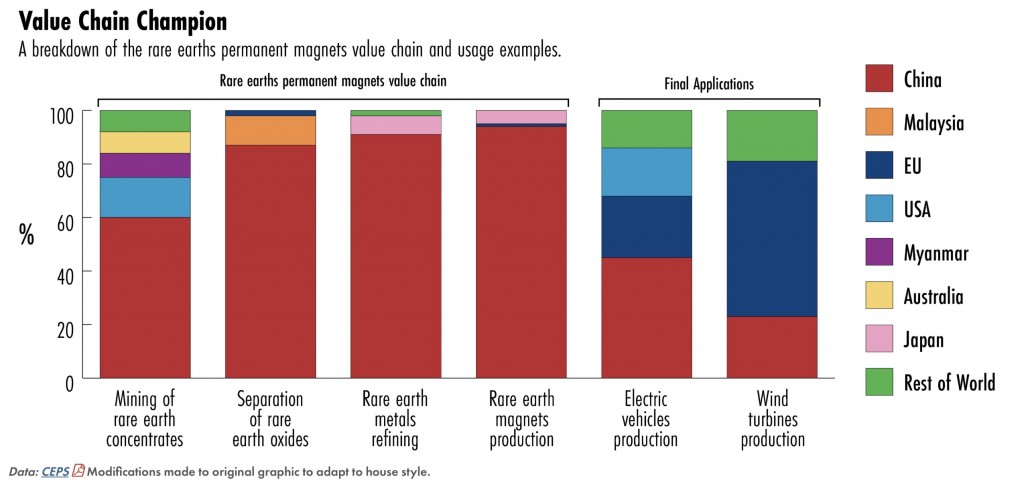

Of course, in light of Beijing’s dominating role in critical mineral supply chains and the current state of global affairs, China’s announcements relating to critical mineral export restrictions are not only highly consequential for U.S. domestic industry stakeholders, but must also be viewed through the prism of geopolitics, and as such U.S. national and economic security.

As Nikkei outlines, the U.S. has in recent years worked with Western allies to tighten exports of top-end semiconductors and chipmaking equipment to China, prompting Beijing to respond by considering banning “exports of manufacturing technology for high-performance magnets and other products that use rare earths” at the end of 2022.

Earlier this summer, China announced export restrictions on gallium and germanium, followed by controls on certain drones and drone-related equipment. On October 20th, Beijing tightened the export control ratchet further – this time by announcing that to protect national security, the country require export permits for certain graphite products – a move analysts see as a play “to control supplies of critical minerals in response to challenges over its global manufacturing dominance.”

From a functional perspective, Chinese restrictions now extend to three of the key tech building blocs of the 21st century:

- Semiconductors (gallium/germanium)

- Lithium-ion battery technology (graphite)

- Permanent magnets (REEs)

As geopolitical tensions soar, this may not be the end of it. As ARPN stated before:

“As China ratchets up its export control regime (…) U.S. stakeholders would be well-advised to kick their efforts to bolster U.S. critical mineral supply chains into high gear. For China – a ‘country of concern’ as per an August 9, 2023 Executive Order - it may be a short step from export controls to export embargoes.”