When it comes to the EV revolution, there really isn’t any doubt — it’s happening, and it’s accelerating. But what does that mean for a society in which the automobile has become a central element in the social and economic structure, and in which the “the personal computer and personal car are co-equal in their transformative impacts? And what are the political and economic implications of the shift?

In a piece posted at Oilprice.com Mark P. Mills (via Zerohedge) takes a deep dive into this question. As Mills points out, with America’s longstanding bond with cars showing no signs of weakening in spite of soaring cost, the push towards widespread adoption of EVs is running into significant challenges in practical application and underlying physics, and, as followers of ARPN well know, a complex mix of chemistry, geology and geopolitics.

Mills laments that the underlying premises of the “ostensible inevitability, the enthusiasm, the subsidies, and the mandates for EVs are anchored in (…) claims (…) that are simply wrong ” – EVs are not simpler than conventional cars, they just have a complexity of their own, they do not entail less labor to build but rather shift where the labor takes place, and the upstream supply chains, i.e. the sourcing of material inputs, happens “elsewhere since the mines and refineries are not in America.”

Meanwhile, the mineral challenges are significant, says Mills:

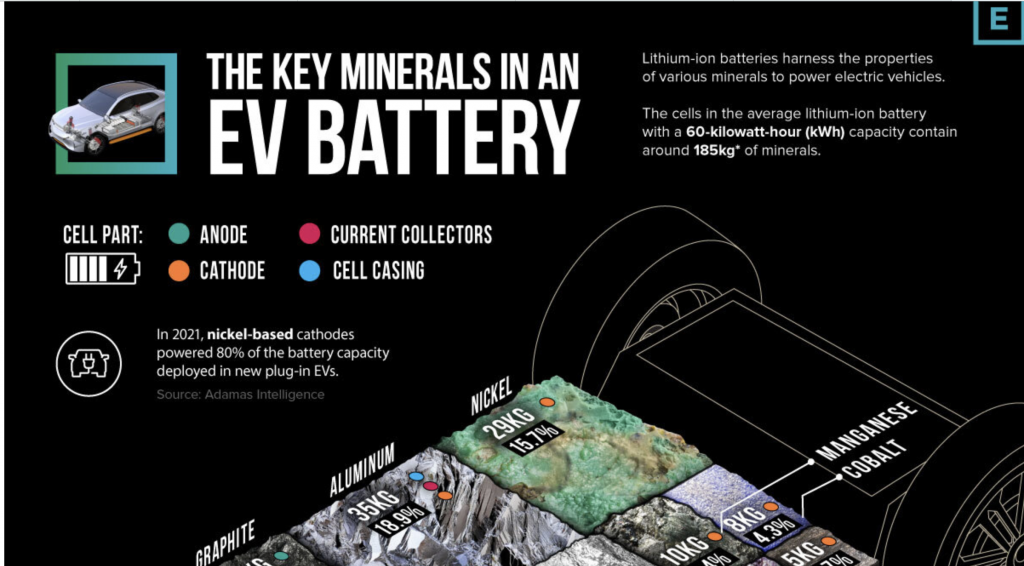

“While copper is the long pole in the tent, it is only one of the mineral challenges. The realities of costs and emissions for EVs is dominated by a simple fact: a typical EV battery weighs about 1,000 pounds to replace the fuel, and the tank weighing together under 100 pounds. That half-ton battery is made from a wide range of minerals including copper, nickel, aluminum, graphite, cobalt, manganese, and of course, lithium. And to get the materials to fabricate that half-ton battery requires digging up and processing some 250 tons of the earth somewhere on the planet. Those numbers, it’s important understand, are roughly the same no matter what the specific battery chemical formulation is, whether it’s lithium nickel manganese, or the popularly cited lithium iron phosphate.”

As the piece points out, the sheer quantity of materials needed “has led proponents to claim that there are, after all enough minerals on the planet and there’s nothing to worry about” – an argument that becomes irrelevant when you consider that “the data show that, overall, the mines operating and planned can’t supply even a small fraction of the 400% to 7,000% increase in demand for minerals that will be needed within a decade to meet the ban-the-engine goals.”

Ultimately, Mills concludes, that “the realities of physics and engineering mean that politicians pushing for an all-EV future run a high risk. Quite aside from the eventual discovery that EVs will disappoint with only a tiny impact on global CO2 emissions, the bigger impacts will come as consumers find vehicle ownership costs and inconveniences both escalating.”

While this may be true, it appears that, to stay with transportation analogies, the train has left the station. Politicians are all in for the EV revolution — but to lessen the blow to consumers, they will need to embrace frameworks that will bolster the domestic supply chains for the critical minerals underpinning this shift, across all segments of the value chain.

As the horse and carriage gave way to the “motor carriage” with its superior horsepower, EVs are inexorably redefining the driving experience, even as internal combustion engines co-exist in some manner. The pace of change will certainly rest on the understanding of the role a host of Critical Minerals play in this transformation – and the willingness to extract them in ways old and new.