Amidst the global push towards carbon neutrality, “Critical Minerals” has become a buzzword. As the green energy transition has gone mainstream and electric vehicles and renewable energy sources dominate the news cycle, so has talk about growing demand for some of the specialized materials underpinning this shift — most notably the Rare Earths, and the battery tech metals Lithium, Cobalt, Graphite and Nickel. A little lost in the media shuffle, though no less important, is Copper — perhaps the unsung hero of the green energy transition.

Less flashy and headline-grabbing than some of its tech metal peers, this mainstay mineral deserves far more credit and attention than it is currently getting. Followers of ARPN will know that we have long touted the versatility, stemming from its traditional uses, new applications and Gateway Metal status.

Copper is also an irreplaceable component for advanced energy technology, ranging from EVs over wind turbines and solar panels to the electric grid. The manufacturing process for EVs requires four times more Copper than gas powered vehicles, and the expansion of electricity networks will lead to more than doubled Copper demand for grid lines, according to the IEA.

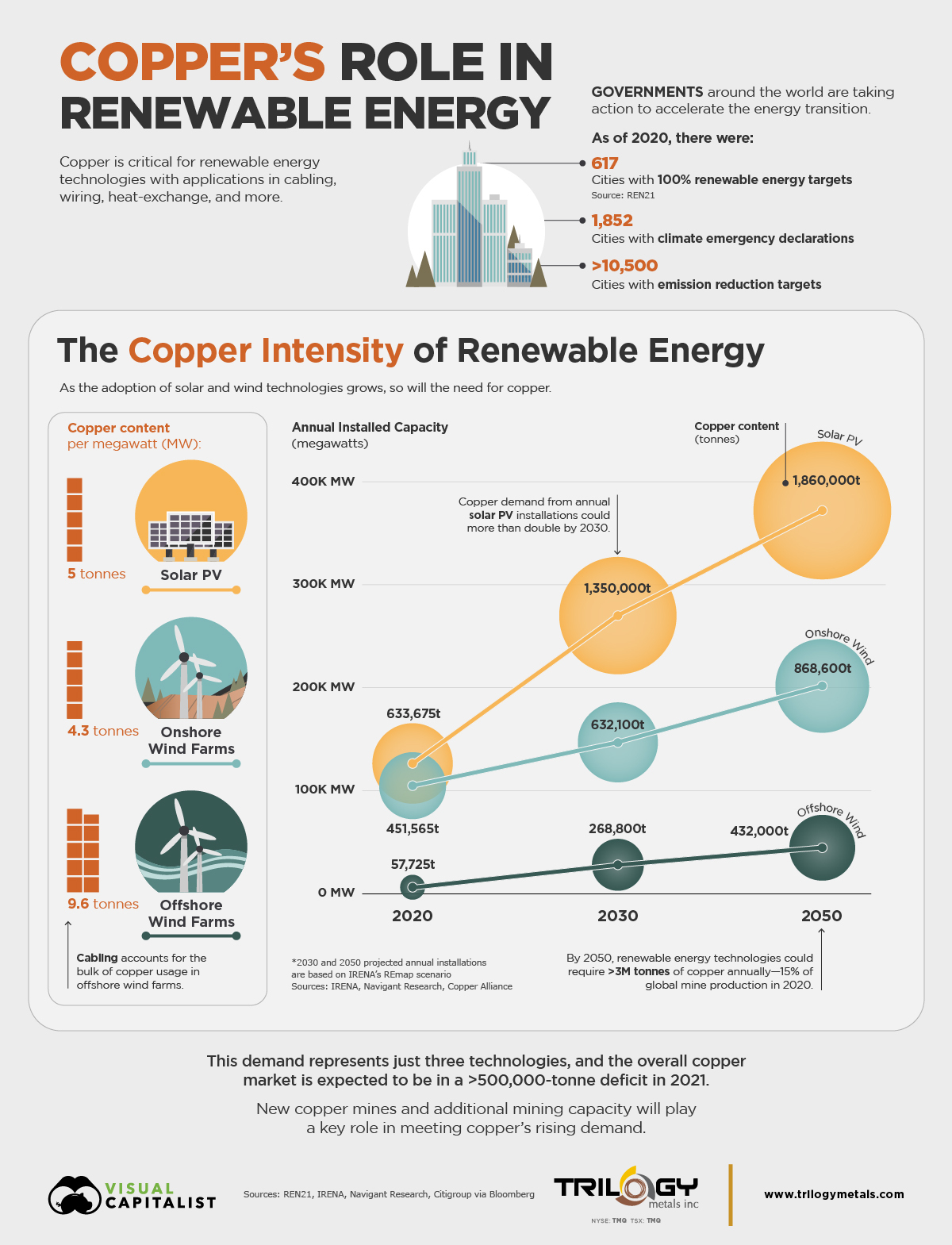

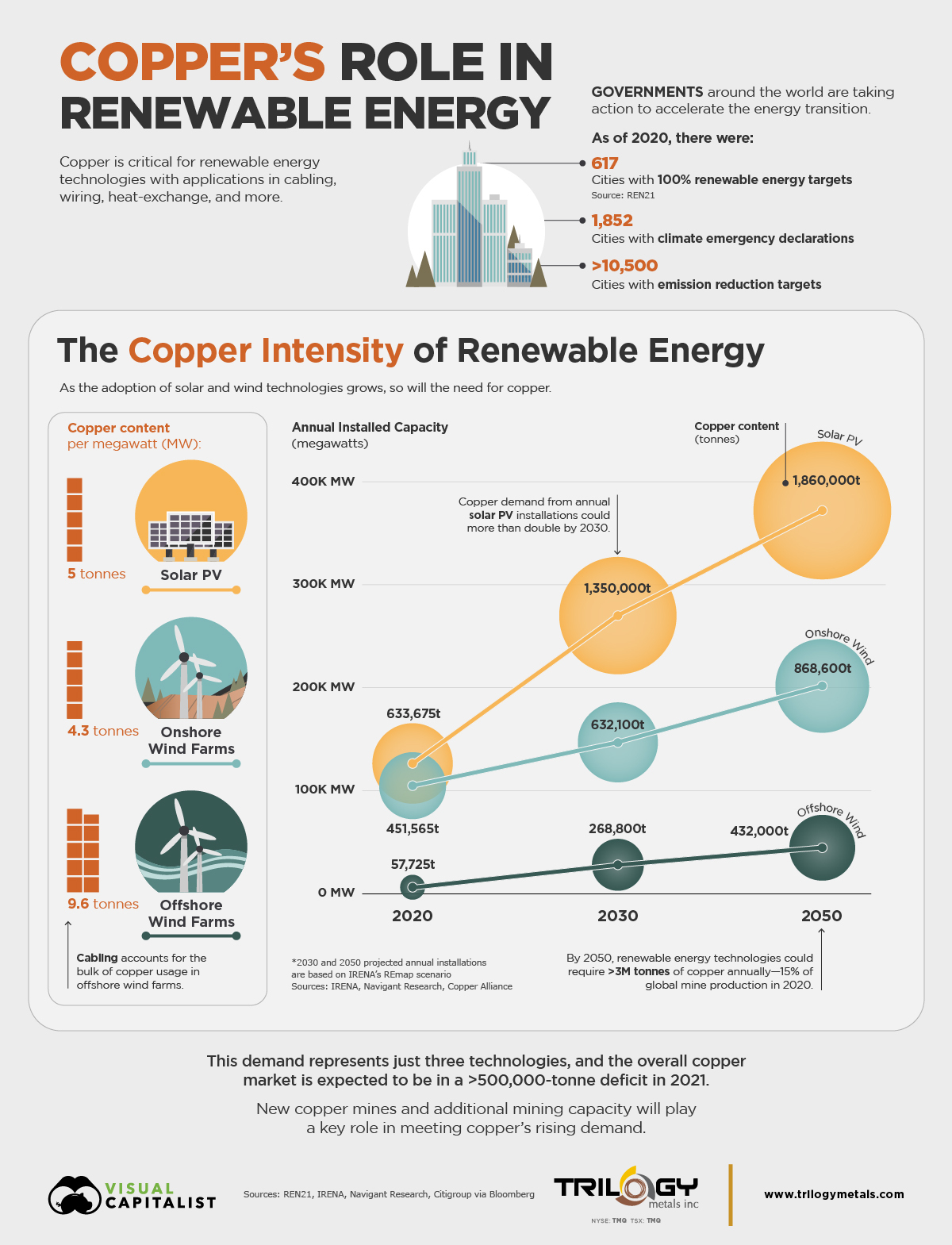

A recent graphic by Visual Capitalist depicts the Copper intensity of the energy transition with a view towards solar and onshore and offshore wind energy technology:

Add in Copper’s Gateway Metal status — the processing of the metal yields access to a host of co-products essential to “manufacturing the advanced technologies that will power our economy for generations to come” such as Cobalt, Tellurium, Molybdenum, Rhenium, Arsenic and REEs — and a 2019 mining executive’s projection that “[t]he world will need the same amount of copper over the next 25 years that it has produced in the past 500 years if it is to meet global demand.

Recent developments in Washington, D.C. — movement on a bipartisan infrastructure package and announcements of new EV goals and fuel efficiency standards — will only add to the outlined Copper demand scenarios.

And the challenge is not just mining, but also processing, as Laura Skaer, a member of the board of directors of the Women’s Mining Coalition and former director of the American Exploration & Mining Association, outlined in a recent piece for Morning Consult:

“Last year, the United States imported 37 percent of the copper we used. China already refines 50 percent of the world’s copper and the United States only refines about 3 percent. National security experts have warned that relying on China for critical supply-chain materials like refined copper poses a serious threat to America’s national security interests.”

The United States Government failed in 2018 to include Copper in its official Critical Minerals list, a faux pas the Canadian government did not commit with the release of its own Critical Minerals list earlier this year, which included Copper along with fellow key Gateway Metals Nickel and Zinc in its list of 31.

Meanwhile, the Biden Administration’s 100-Day Supply Chain Review highlights Copper as an integral component of Lithium-ion battery technology, in the context of being what we have called a “gateway metal” to other critical materials, and for its “use across many end-use applications aside from lithium-ion cells, including building construction, electrical and electronic products, transportation equipment, consumer and general products, and industrial machinery and equipment.”

Here’s hoping that the greater prominence given to Copper — both as a standalone material and Gateway Metal — by the White House 100-day report is an indication that a forthcoming updated U.S. Critical Minerals List will acknowledge the metal’s ever-growing importance. Until then, Copper will remain one of the most “Critical Non-Criticals,” as we note in ARPN’s recent report, Critical Mass.