While just a few short years ago, Rare Earth Element coverage dominated non-fuel mineral resource news cycles, it is the metals and minerals that fuel electric vehicle and battery technology that are making headlines these days.

Here, the spotlight has been on Cobalt, Lithium, and, to a lesser extent, Nickel and associated supply and demand scenarios, but Copper — both a traditional mainstay metal and tech metal in its own right that also serves as a “Gateway Metal” to several other tech metals — also warrants attention. Perhaps less flashy than its peers, Copper is widely used in electric vehicles, charging stations, and supporting infrastructure.

But along with these new uses of a long-mined metal, Moody’s Investors service offers a warning:

“Supply constraints affecting cobalt, lithium, copper and nickel, key metals for making the batteries that power electric cars, could slow production rates of [EV] power storage units in the near term.”

Mining.com cites Carol Cowan, a Senior Vice President at Moody’s:

“Declining ore grades for copper, continued lack of investment in new mines and the time required to bring new discoveries to production will constrain metal availability and, ultimately, the metal sector’s ability to meet growing demand from automakers for battery electric vehicle production.”

Moody’s, which also expects Nickel and Cobalt supply insufficiencies against the backdrop of growing demand for EV battery technology, anticipates Copper consumption to greatly outstrip supply as it is slated to increase more than six times.

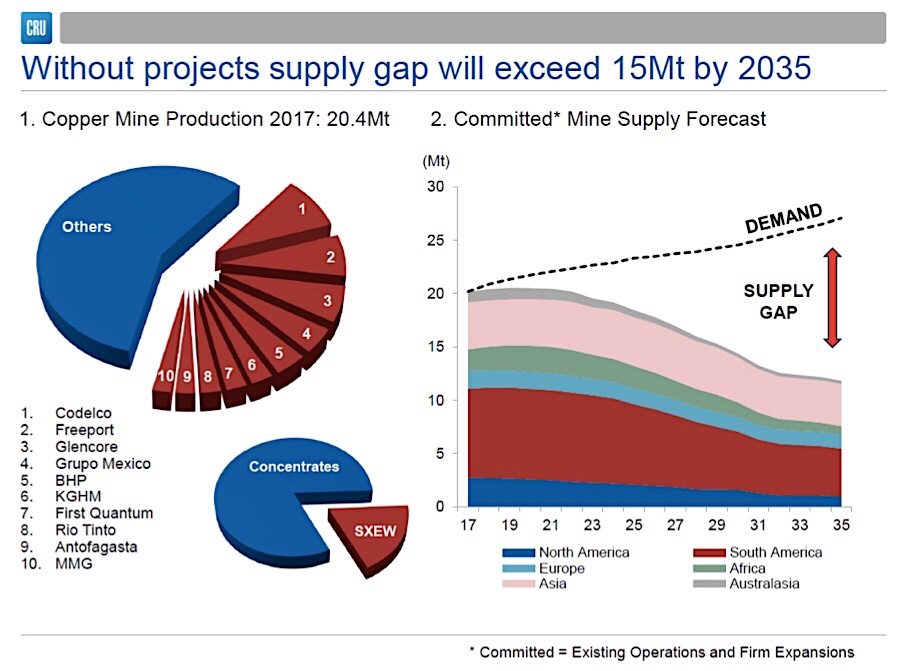

CRU analyst Hamish Sampson estimates that “unless new investments arise, existing copper mine production will drop from 20 million tonnes to below 12 million tonnes by 2034, leading to a supply shortfall of more than 15 million tonnes.”

Sampson, who had previously pointed out that over 200 currently-operating Copper mines will be reaching the end of their production cycle before 2035, has put together a graphic that paints a drastic picture of a looming Copper gap, of which ARPN’s Dan McGroarty had warned as early as 2013:

Only if “every single copper project currently in development or being studied for feasibility is brought online before then, including most discoveries that have not yet reached the evaluation stage, the market could meet projected demand,” said Sampson according to Mining.com.

All of this his goes to underscore what ARPN has long touted, and most recently outlined in our new report on the inter-relationships between Gateway Metals and their Co-Products:

Copper is “far more than just your old school industrial metal” — which is why including it into the draft critical minerals list released by Secretary of the Interior Ryan Zinke would be a common sense proposition.