We’re sticking with the visuals this week.

In our last post, we featured a Visual Capitalist depiction of the lithium supply chain which underscored the urgency for the U.S. to build out our domestic lithium development capabilities.

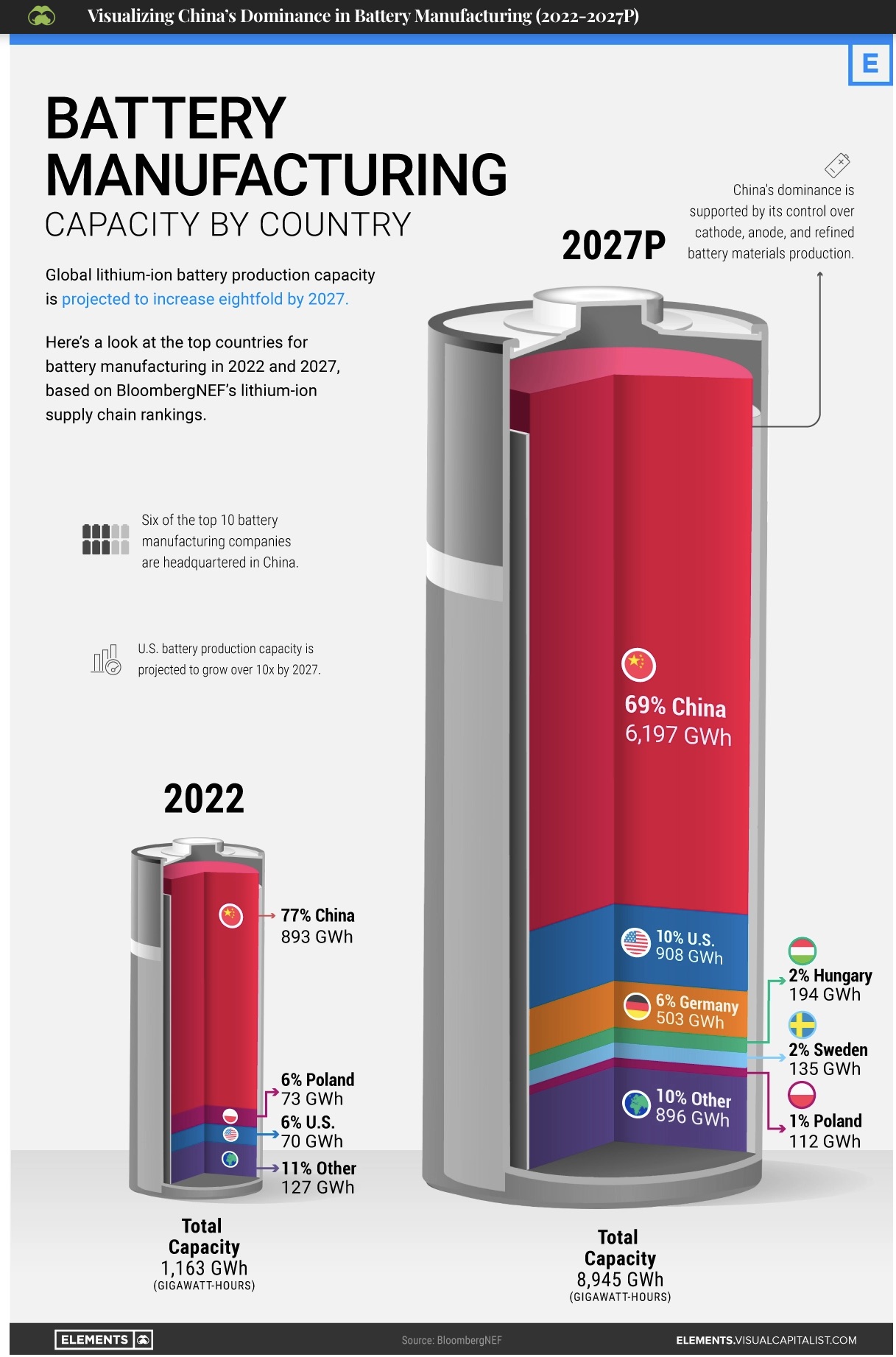

Our second featured graphic comes once more via Visual Capitalist, but this one takes a broader look at the global battery manufacturing landscape. It’s a stark reminder of China’s dominance in the critical mineral resource realm. It does not take many words to drive home the point:

As Visual Capitalist points out, China, which is home to six of the world’s ten biggest battery makers, in 2022 clocked in at almost 900 gigawatt hours of manufacturing capacity, or 77% of the world’s total. Its global lead is supported by Beijing’s “control over cathode, anode, and refined battery materials production.”

As Visual Capitalist points out, China, which is home to six of the world’s ten biggest battery makers, in 2022 clocked in at almost 900 gigawatt hours of manufacturing capacity, or 77% of the world’s total. Its global lead is supported by Beijing’s “control over cathode, anode, and refined battery materials production.”

While, thankfully, projections see the United States expanding battery manufacturing capacity more than tenfold by 2027, overall China is expected to remain firmly in the lead with an expected 69% of the world’s total by that year.

Visual Capitalist closes its discussion of the chart by asking the question that’s on everyone’s mind: “Can countries cut ties with China?”

The bottom line, according to VC:

“Regardless of the growth in North America and Europe, China’s dominance is unmatched.

Battery manufacturing is just one piece of the puzzle, albeit a major one. Most of the parts and metals that make up a battery—like battery-grade lithium, electrolytes, separators, cathodes, and anodes—are primarily made in China.

Therefore, combating China’s dominance will be expensive. According to Bloomberg, the U.S. and Europe will have to invest $87 billion and $102 billion, respectively, to meet domestic battery demand with fully local supply chains by 2030.”

It is a daunting challenge, but it is one that the world, and from an ARPN perspective, U.S. stakeholders will have to take on, because China continues its external quest to secure critical mineral resources, “ramping up its internal hunt for critically important minerals and energy resources to bolster strategic reserves, as Beijing doubles down on economic security and continues to warn of the rising risks associated with relying on external markets,” according to the South China Morning Post.

The publication cites Wang Guanghua, China’s minister of natural resources, as telling the state-run news agency Xinhua: “China has a high degree of foreign dependence on some important mineral resources, and once the international situation changes, it will certainly affect economic security or even national security.” And while there are verbal affirmations of “promoting a higher level of opening up,” to spur innovation, all indications are that China’s president Xi Jinping is tightening the reins and seeking stronger party control over the country’s key industrial sectors.

Cases in point are rapidly accumulating. ARPN recently featured the Chinese Ministry of Industry and Information Technology’s announcement that it will increase supervision of China’s lithium battery supply chain, and the establishment of a new state-owned group to serve as a consolidated hub for the country’s iron ore trade — China Mineral Resources Group.

What’s next in this trend towards tighter state control? Foreign Policy posits that we will see more of Xi’s vision of innovation being “one in which the state and party play a leading role” in the construction of Xiong’an — a futuristic “smart city” being constructed south of Beijing which may provide a window into his ambitions in line with “China’s long history of using model cities to communicate political ideals.”

In the meantime, as we stated in previous posts, efforts to decouple supply chains from China may become “all the more pressing in light of current fears that (…) China may retaliate after the U.S. Department of Commerce announced sweeping limitations to semiconductor and chip-making equipment sales to Chinese customers this fall.” With Mr. Xi reportedly seeing the possibility of a showdown with the West as “increasingly likely” in the context of his goal to “restore China to what he believes is its rightful place as a global player and a peer of the U.S.,” America and its close allies would be well advised to move critical mineral supply chain security to the top of their priority lists.

With that goal in mind, — and for all the visual learners out there – maybe the Visual Capitalist chart above is your wakeup call.