Voters of Taiwan have spoken, and have elected the current vice president, Lai Ching-te, the presidential candidate whom China most distrusts according to the Wall Street Journal, as their new president. As Chun Han Wong writes for the Journal, his election “puts at risk a fragile détente between Washington and Beijing, threatening another flare-up between the world’s biggest economic and military powers.”

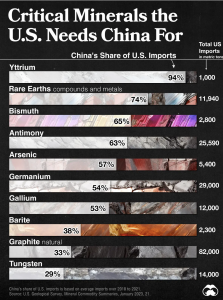

ARPN has been keeping a keen eye on U.S.-China relations, but if you needed a visual reminder on why it matters beyond economic and military might, Visual Capitalist is here to help and has released another great chart depicting China’s dominance of critical mineral supply chains.

Using USGS data, the expert chart makers have visualized China’s share of U.S. imports for ten critical minerals:

Sometimes a picture says more than a thousand words, but if you need more context, Visual Capitalist also provides some additional context here, and points to USGS estimates that if China were to cut off 40-50% of rare earth oxide production, it could disrupt global supply to the point where it would impact U.S. defense systems advanced component suppliers.

Followers of ARPN are aware of the increasing weaponization of trade in the context of U.S.-Chinese relations, and in particular the role of export controls, such as the ones imposed by China on germanium and gallium, as well as graphite and rare earths.

As such, it comes as no surprise that U.S. policy stakeholders are taking a firmer stance on policies relating to China, particularly in an election year. See our post on the U.S. House vote to overturn the waiver of “Buy America” requirements for taxpayer-funded EV charging stations here.

However, these waiver requirements are just the tip of the proverbial iceberg. Mandates to source domestically or from allies can only work if there is a framework conducive to harnessing these resources, so this election cycle and beyond candidates and other stakeholders should prioritize strengthening domestic critical mineral supply chains where possible, and friend shoring, where necessary.

As geopolitical flashpoints continue to increase, so do the stakes.