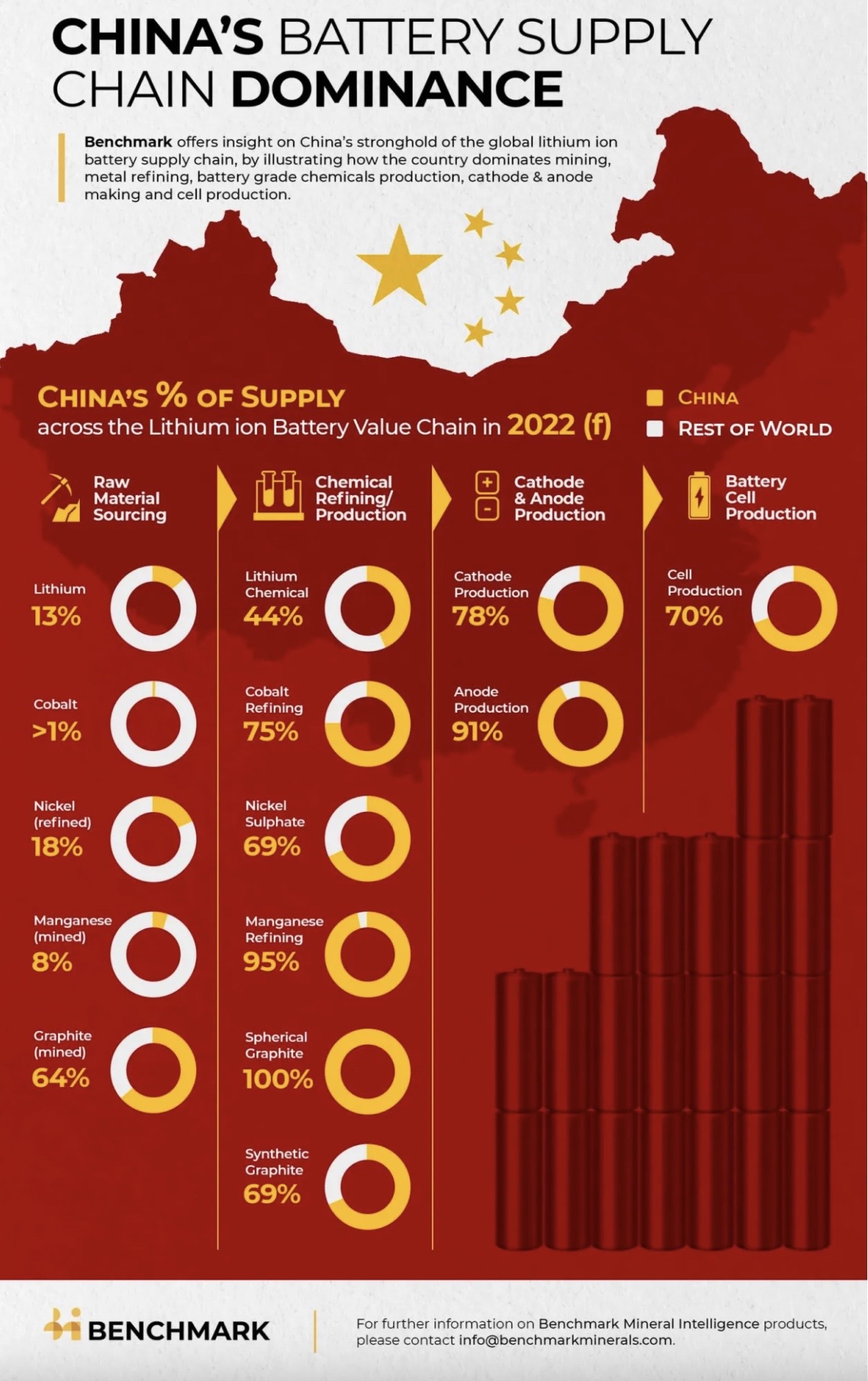

It’s Halloween – time for trick or treating, spooky storytelling and scary visuals. Here’s a real scary one if you’re still looking to frighten the policy wonks among your Halloween party guests. Courtesy of our friends at Benchmark Mineral Intelligence, it’s an infographic that should send a serious chill down policy makers’ spines, and it’s not even gory:

While stakeholders have taken some important steps to decouple from China in the wake of critical mineral supply chain wake-up calls against the backdrop of the coronavirus pandemic and rising geopolitical tensions, we are still — and likely will be for a while — at the mercy of China when it comes to securing our EV battery supply chains, which are at the core of the green energy transition.

As Benchmark outlines,

“While most of the world’s lithium, nickel, cobalt, and manganese for batteries is mined outside of China, the majority of all critical minerals for the battery supply chain are further refined and processed in China.

With the exception of mining, China controls at least half of the supply from every step needed to make a lithium ion battery.”

As if “at least half” wasn’t scary enough, let’s take a look at graphite — a key ingredient for the anode side of Lithium-ion batteries: According to Benchmark Mineral Intelligence, China mines 64% of natural flake graphite, and it has a “monopoly on converting [it] into the spherical graphite needed for anodes.”

It gets worse from there. Says Benchmark Mineral Intelligence:

“In 2022, Benchmark forecasts 70% of all batteries will be made in China. This is supported by strong control of the midstream, with a near monopoly over anode production and over three-quarters of cathode production.”

Right now, according to the U.S. Geological Survey, the U.S. is 100% import-dependent for graphite. But that’s not for lack of known graphite resources. As USGS noted in February 2022 in its updated U.S. Mineral Deposit Database, Graphite One’s Graphite Creek deposit near Nome, Alaska is America’s largest graphite deposit. If U.S. Government efforts to develop an American-based EV and lithium-ion battery supply chain have any hope of succeeding, looking for ways to help projects like Graphite Creek down the path to production will be, in a word…. Critical.

Until then, China’s battery anode dominance could be the West’s Achilles heel in the green energy transition – in defense planners parlance, a potential “single point of failure”: irrespective of whether we succeed in developing multiple minerals and metals for the battery cathode, if we can’t meet anode material needs – and we cannot without natural graphite — we can’t build a rechargeable battery independent of China. Scary thought, indeed.

The sourcing provisions in the energy passages of the recently passed Inflation Reduction Act, coupled with the recently announced grants to “supercharge” U.S. EV battery and electric grid supply chains are important steps towards mitigating that potential single point of failure. However, considering the long timelines for permitting for mining and processing projects, decoupling and building out a battery supply chain independent of China will warrant a concerted effort by stakeholders and policy makers to decouple from China.

Are we scared enough to take on the challenge?