If history holds one important lesson for us, it’s that most things in life are cyclical.

Low tide and high tide, ups and downs, times of war, times of peace. What holds true on a personal level, also applies to bigger fields like economics.

As value investor and author Howard Marks phrased it:

“Mechanical things can go in a straight line. Time moves ahead continuously. So can a machine when it’s adequately powered. But processes in fields like history and economics involve people, and when people are involved, the results are variable and cyclical.”

Commodity markets are a case in point. As Wells Fargo Head of Real Asset Strategy John LaForge phrased it in a recent white paper, “[c]ommodities typically move together like a big family, through long boom (bull markets) and bust (bear markets) cycles.”

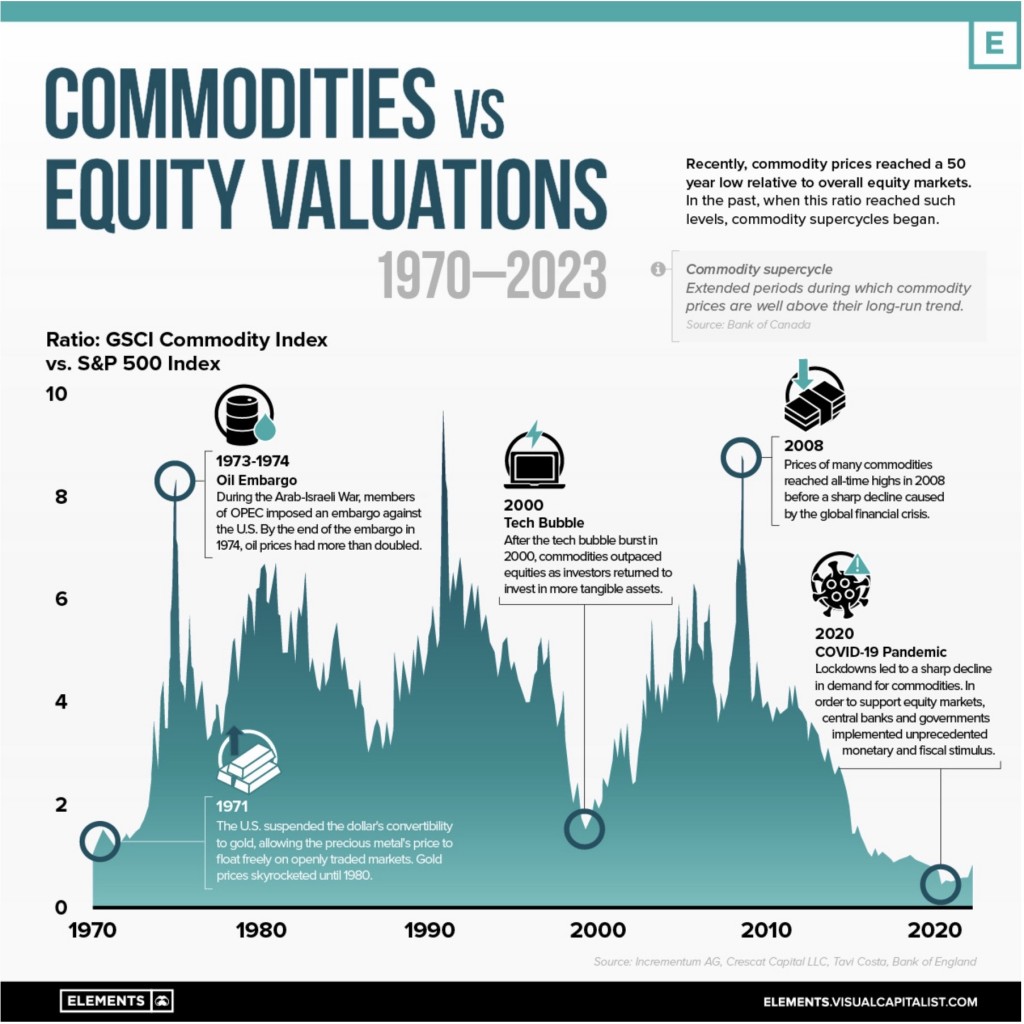

After a “brutal decade for commodities in the aftermath of the 2008 financial crisis,” in the wake of which “investors had all but abandoned the asset class in favor of equities,”, as Rick Mills writes for Ahead Of The Heard, it appears that we find ourselves at the beginning of what experts call a commodity supercycle (defined by Bank of Canada as an “extended period during which commodity prices are well above their long run trend”) – a phase predicted by analysts for several years.

Writes Bruno Venditti for Visual Capitalist:

“In recent years, commodity prices have reached a 50-year low relative to overall equity markets (S&P 500). Historically, lows in the ratio of commodities to equities have corresponded with the beginning of new commodity supercycles.”

Not surprisingly, Visual Capitalist has put together a handy chart and provides some useful context:

Wells Fargo’s LaForge believes that we have already entered a new commodity supercycle that started in 2020, and with these cycles typically lasting a decade or longer, we are merely in the “third inning.”

However, while, as Mills points out, “all supercycles have three indicators in common – a surge in supply, a surge in demand, and a surge in price” – this new commodity supercycle could “look a bit different from the previous ones for one simple reason – an increased focus on climate change.”

As JP Morgan writes, “climate change policies may lead to the largest peacetime redeployment of investment and capital,” with demand for critical minerals, especially the battery criticals lithium, graphite, nickel, cobalt and manganese, as well as others underpinning the green energy shift like copper and the rare earths surging to unprecedented heights.

Analysts for metals retailer and commodities media organization KITCO believe that “while overall market conditions in critical metals remain volatile, the long-term fundamental drivers are strong.”

They add:

“Governments and corporations continue to ramp up large-scale investments in critical metals like lithium, uranium, copper and nickel, with the goal of onshoring the primary components of energy transition infrastructure and securing a resilient and sustainable supply chain. This considerable task — the reversal of the movement over the past three decades to increase globalization and offshoring to low-cost producers and supply sources — is in its early stages today. But despite its nascency, this powerful trend will have considerable consequences for commodities, capital markets and inflation.”

Bumps are to be expected, but the trajectory for now, is expected to be a longer upward trend.

How do U.S. and our allies’ mineral resource stakeholders in the United States fit into this supercycle?

Mills does not mince words:

“Here in the West, it isn’t only that we have failed to maintain mining and oil investments. We have also put roadblocks in the way of mining, such as the lengthy permitting process in North America. In Canada we’ve let interest groups hostile to corporations dictate resource policy.

We haven’t built the necessary infrastructure, either. (…)

All of these factors are limits to growth.”

He does see a silver lining, however, in the fact that “North Americans are finally starting to realize that to have security of supply, we need to develop our own mineral deposits.”

He concludes:

“The first step is recognizing that we have these metals, we do not need to purchase them from China, the DRC, Russia or any other foreign producer, we can mine and refine them right here.

Next is upping our exploration game — and nobody is better at it than Canadian junior resource companies — so that we can find and develop the deposits that will become the world’s next mines.”