As CNN writes, “this year’s Super Bowl viewership can be neatly divided into four segments: Those who like football and Taylor Swift, those who only like football, those who only like Taylor Swift, and those who like neither but are, for whatever reason, watching anyway.”

For most, there’ll be plenty to talk or fight about, but if you’re in the fourth segment, or are simply looking for a different conversation topic at the viewing party you’re attending, here’s some food for thought and discussion, courtesy of the Minerals Council of Australia. The Council has put together a great wall calendar for this year, the year of the XXXIII Olympiad, visualizing the metals and minerals that make sporting moments possible.

Sports moments covered on the calendar range from the Australian Open in tennis over the U.S. Masters golf tournament to the premier bicycle race in the world, the Tour de France among others.

Not surprisingly, the Super Bowl, which has the Kansas City Chiefs facing off against the San Francisco 49ers at Allegiant Stadium in Las Vegas this Sunday, made the month of February in the calendar.

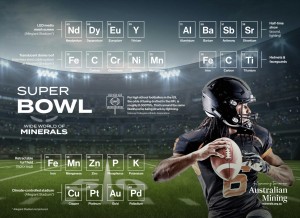

Take a look at the fun visual of what metals and minerals make up the giant LED mesh screen at Allegiant Stadium, enable the half time show, made the construction of the translucent dome tent possible, went into the motorized retractable turf field, and provide the comforts of a climate-controlled stadium here:

To followers of ARPN, most of the metals and minerals will look familiar because most of them also feature on the U.S. government’s Critical Minerals List (or, in the case of Copper, should be featured on it, as we have frequently outlined.) and make an appearance on the “Blue Wall of Dependency” in USGS’s most recent Mineral Commodity Summaries, as the U.S. is import-reliant for many of them.

With Taylor Swift having become a massive draw for the Chiefs and the NFL, the term “Era” gets tossed around a lot, alluding to the megastar’s record breaking concert series. Some say Taylor Swift is in her “NFL Era,” many Swifties previously indifferent about football consider themselves in their “Chiefs Era,” and the NFL has been said to have entered the “WAG Era.” While these labels are subjective and only apply to certain people or groups of people, there is no denying that collectively, we have all entered the Tech Metals Age, to keep with the time period label theme.

Once the motorized turf has been retracted at Allegiant Stadium, the conversation should shift towards securing the supply chains that underpin the technological advances of said Tech Metals Age that allow us to not only enjoy the Super Bowl, the Olympics and the World Series (all of which are also featured on the calendar), but also the conveniences of everyday life, as well as our national and economic security.