As the Wall Street Journal reports, a new OECD study has found that export restrictions on Critical Minerals have increased more than fivefold from January 2009 to December 2020, suggesting that “export restrictions may be playing a non-trivial role in international markets for critical raw materials, affecting availability and prices of these materials.”

While this significant shift to export controls – according to the WSJ mostly in the form of taxes – has been noticeable and relevant, it may just have been the tip of the iceberg.

In the wake of a global pandemic, related supply chain shocks and with the Russia-Ukraine war raging on, the trade dimension of geopolitics has become the new frontier in the tech wars between Beijing and Washington, DC – a relationship in which conflict has been smoldering over the past few years, especially over Rare Earth Elements (REEs).

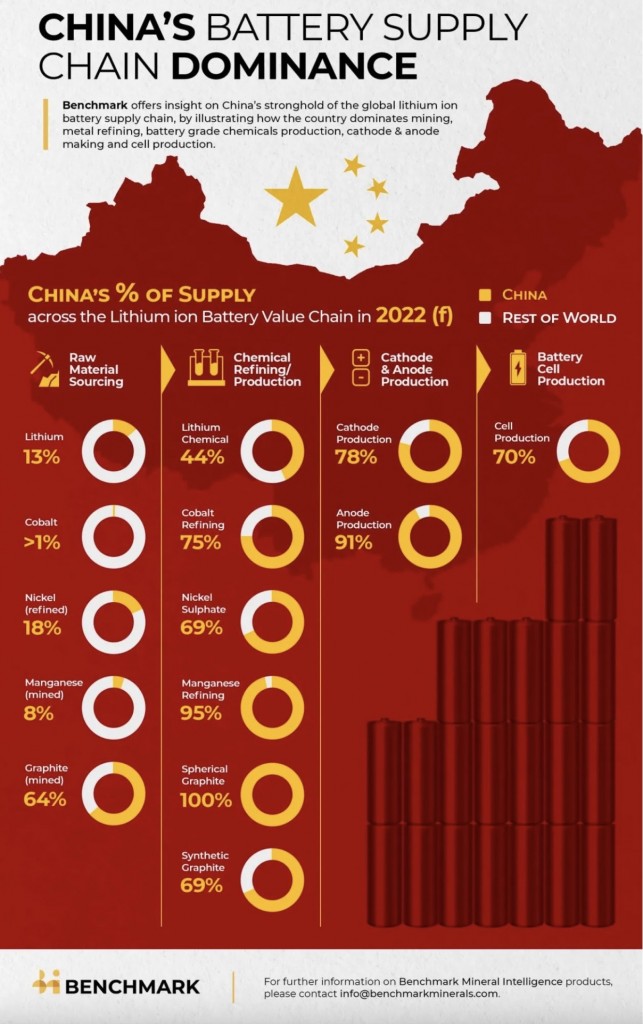

As we outlined in a recent post, Western nations have made decoupling from China – which has long held a strategic stranglehold over Critical Mineral supply chains – a priority and have pursued a strategy of “friendshoring.”

Observers were waiting to see if China would retaliate in response to the United States’ recently imposed set of sweeping controls on advanced semiconductors and semiconductor manufacturing equipment aimed at China and a related agreement with Japan and the Netherlands.

It may not prove to be a long wait. According to Nikkei reporting earlier this month, China has since announced that it is considering prohibiting exports of certain rare earth magnet technology through updates to a technology export restrictions list last issued in 2020.

The looming export control ratchet and increasing tensions between China and the West are troubling South Korea – which has in the past walked a fine line between the United States and China – its “leading economic partner and increasingly dominant neighbor” – and has publicly balked at the U.S. effort to isolate China from semiconductor supply chains.

Regardless of that fine line, public opinion towards China has been souring in South Korea, and diplomatic relations with the country are also getting tense as Seoul summoned China’s ambassador to protest Beijing’s criticism of remarks made by President Yoon in an interview with Reuters on Taiwan.

The looming specter of China restricting technology exports has South Korea’s industrial sector worried, prompting the government to announce a “strategy to secure core minerals” to reduce its dependence on Chinese critical mineral imports for from the current 80 percent to 50 percent by 2030.

In the context of this strategy, the South Korean Ministry of Trade, Industry and Energy designated 33 as critical minerals and named 10 of those as strategically critical minerals, including the “battery criticals” lithium, nickel, cobalt, manganese and graphite and five types of rare earth materials considered crucial in 21st century tech applications including the manufacture of semiconductors. ARPN followers will note that Korea’s 10 “strategically critical minerals” list – assuming the five REEs are those used in permanent magnets — squares up with ARPN’s “Super Criticals,” circa April 2022.

As part of a push to “expand and strengthen bilateral and multinational cooperation with resource-rich countries” a public-private delegation of officials from South Korea’s public and private sectors is currently visiting Chile and Argentina to “explore ways to boost cooperation on supply chains of lithium and other major minerals and the development of natural resources.”

The country is also stepping up domestic and global investment. Last month, South Korean President Yoon Suk Yeol announced that the government and companies including Samsung Electronics Co. would invest $422 billion into chip making and EV manufacturing projects in what Bloomberg calls “the nation’s most aggressive effort yet to win a heated global race for tech supremacy.”

Seoul is further looking to provide $5.32 billion on financial support to its domestic battery makers looking to invest in infrastructure in North America, while also looking to upgrade its partnership with India with a focus on trade, investment and strengthening critical mineral supply chains. To put South Korea’s $5.3 billion in context, at 1/12th the size of the U.S. economy, that’s equivalent to the U.S. Government allocating more than $60 billion to Critical Mineral supply chains.

Whether or not China escalates export controls for critical minerals remains to be seen – though officials already finished taking expert comments on the planned restrictions reported by Nikkei earlier this month and the changes are expected to go into force this year – it is becoming increasingly clear that a “huge realignment” in the critical minerals space is underway, and its one that not only sees the West looking to reduce Chinese resource dominance, but also sees allegiances shift in Asia itself.