Earlier this month, Simon Moores, Managing Director of Benchmark Mineral Intelligence and member of the ARPN panel of experts testified before the full U.S. Senate Energy Committee on opportunities and risks in the energy storage supply chain.

Earlier this month, Simon Moores, Managing Director of Benchmark Mineral Intelligence and member of the ARPN panel of experts testified before the full U.S. Senate Energy Committee on opportunities and risks in the energy storage supply chain.

We’re titling his observations as Moores’ Law — which is his for the taking, given the placement of the apostrophe. If he hasn’t used it yet, he should.

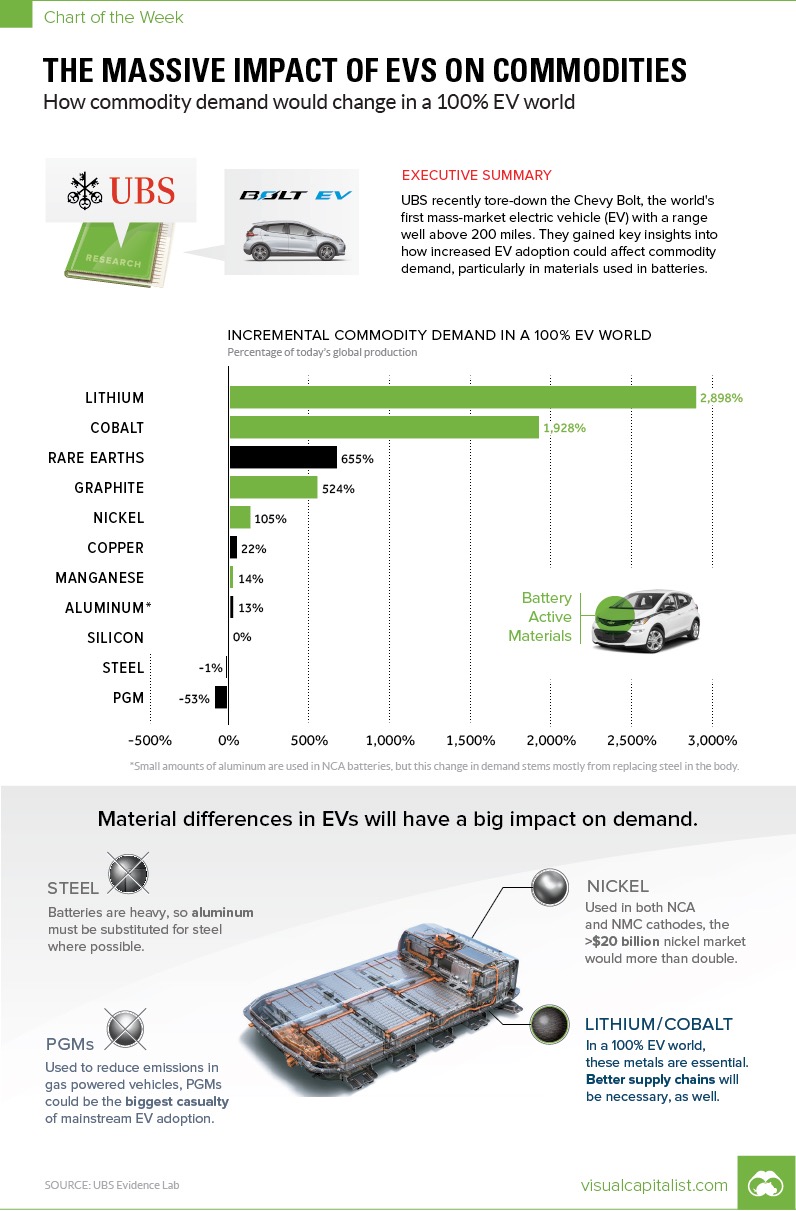

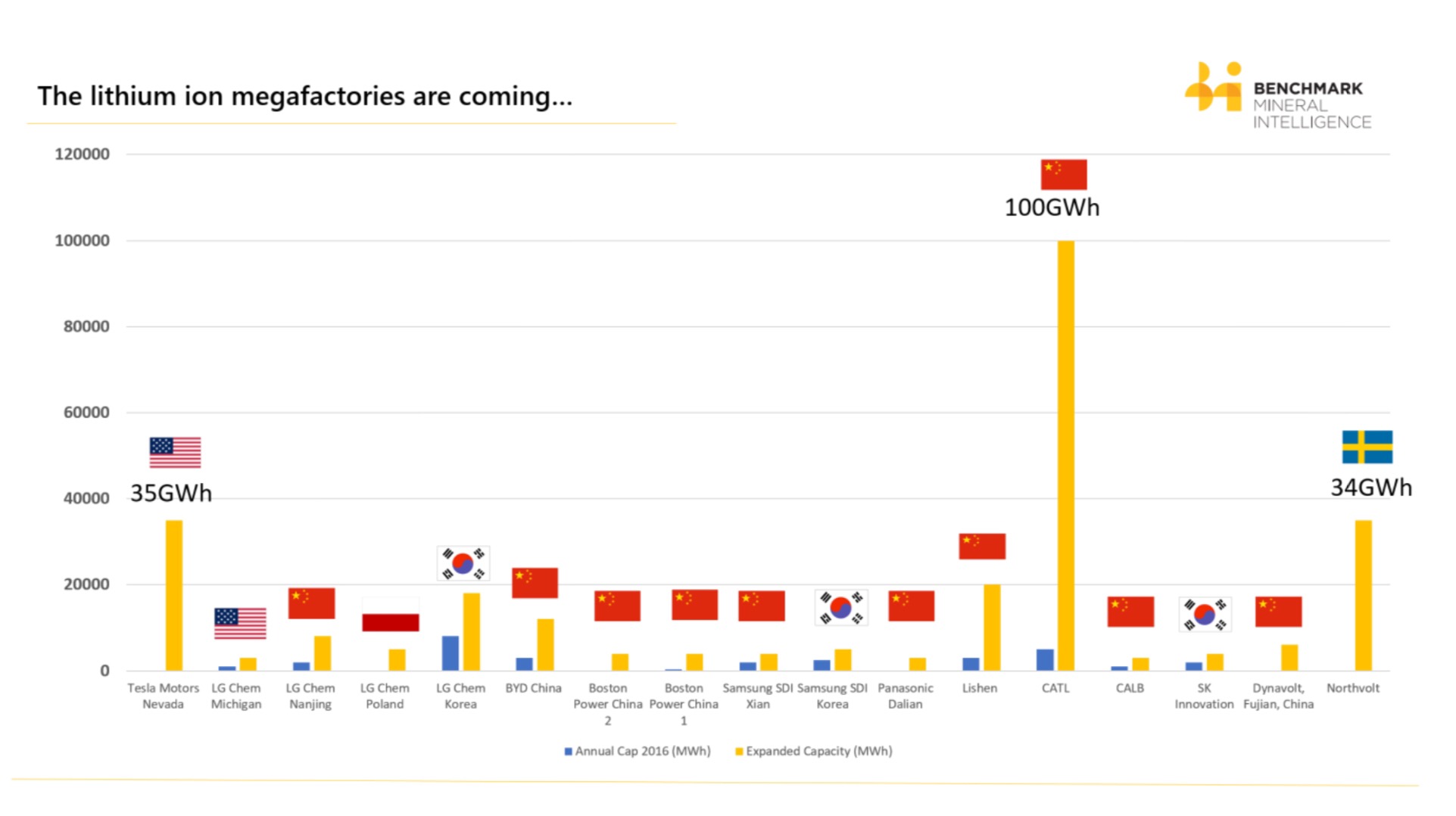

While we already featured Moores’ top line points regarding the rise of Lithium Ion megafactories (also see the chart), we would be remiss if we didn’t share some of his takeaways on the implications for the main critical raw material inputs for this technology – namely Lithium, Graphite, Cobalt, and Nickel — and add some additional thoughts.

Lithium

• For Lithium carbonate and Lithium hydroxide, the “base chemicals that the battery industry seeks,” Benchmark Mineral Intelligence sees a 10-fold increase in the industry’s demand profile over a ten-year timeframe. Lithium is largely sourced from Chile, Argentina and Australia, and is processed into battery grade in the U.S. and China.

• Meanwhile, in a recent op-ed for the Reno Gazette Journal, professor emeritus of mining engineering at the University of Nevada, Jaak Daemen, citing an even higher demand profile increase for Lithium, argued that with only one Lithium mine in the U.S., the United States is unprepared to meet demand with the main problem not being the lack of resources, but “a regulatory approach that endlessly delays bringing mines in production.”

Graphite

• Lithium Ion technology uses both naturally mined flake Graphite as well as synthetic Graphite, in which the former accounts for roughly 60% of inputs, and the latter for roughly 40%. According to Moores’s testimony, China dominates natural flake mining at 62% of global production in 2016, followed by Brazil at 23%. A similar scenario unfolds for refining, most of which also takes place in China.

• According to Moores, “[w]hile large flake graphite mines are being developed outside of China in Mozambique, Canada and the US, processing capacity to make anode material is still lagging.”

• As we previously highlighted, the U.S. currently produces zero Graphite, with the last American Graphite mine having closed 25 years ago.

• As Moores points out, however, two Graphite companies are currently seeking to mine and process flake graphite for battery grade material in the U.S., so there is hope the supply picture will change domestically.

Cobalt

• According to Moores, 64% of the Cobalt consumed globally in 2016 was mined in the Democratic Republic of the Congo (DRC), with China dominating the “refining step in the supply chain with 57% of global capacity.”

• With Cobalt also being a Co-Product to Gateway Minerals like Copper and Nickel, Moores argues that “the fortunes of Cobalt – now driven by battery demand – is still at the mercy of Nickel and Copper commodities which is drive by industrial demand. This is causing long term planning issues for the EV supply chain.”

• You can read ARPN’s latest blog item on Cobalt here.

Nickel

• With advances in battery technology and changing formulas, Moores sees battery grade Nickel demand grow “from 75,000 tpa in 2016 to anywhere between 300-400,000 tpa by 2025.”

• Nickel production is in the million of tons a year, and from a U.S. point of view, the supply picture recently changed with our import dependence dropping from roughly 50 percent to currently 25 percent with new domestic projects having come online.

• However, as Moores points out, “the battery grade chemical material is specialist with only a handful of major producers outside of China.”

Ultimately, this is food for thought for any discussion regarding the comprehensive mineral resource strategy our nation sorely needs.

Says Moores:

“Where we stand today in 2017, China is not only a the center of mass market EV development and deployment but also of cathode production, battery grade raw material refining and the building of the new battery cell capacity. Those that control raw material and chemical / cathode refining know how and capacity will control the lithium ion battery supply chain. And those that control the lithium ion battery supply chain will be the biggest influencers on the next generation auto and energy industries.”