Just last week, we highlighted the surge in EV technology and its implications for mineral resource supply and demand. A timely subject – as evidenced by the fact that the U.S. Senate Committee on Energy held a “Full Committee Hearing “to Examine Energy Storage Technologies” this week.

Simon Moores, Managing Director of Benchmark Mineral Intelligence and member of the ARPN panel of experts, was invited to testify on opportunities and risks in the energy storage supply chain. In his testimony, Moores outlined the “rise of the lithium ion battery megafactories,” and shared Benchmark Mineral Intelligence’s assessment of the development of the two largest growth markets for which these lithium ion batteries will be targeted – EV and stationary/utility storage, which Moores characterized as the “two uses that underpin the energy storage revolution.”

Said Moores:

“Both markets are in their infancy. However, as these markets mature over the next 10 years, the scale of application and its disruptive effect on established auto and energy industries will be unprecedented.”

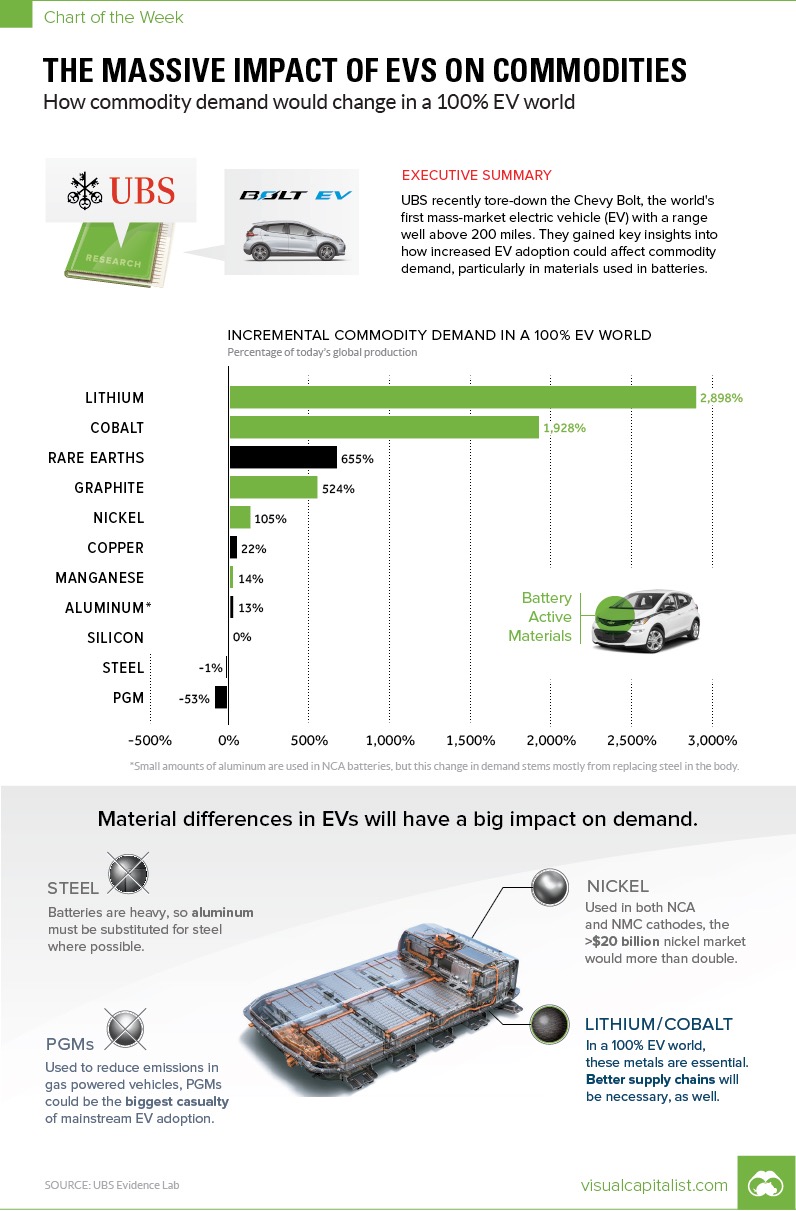

Moores then discussed the critical raw material inputs fueling lithium ion technologies — Lithium, Graphite, Cobalt and Nickel — with an eye towards the United States’ current and prospective role in these respective markets. While outlining opportunities, Moores also warned of great risks:

“The demands EV manufacturers are placing on raw material miners to chemical processors and cathode manufacturers are huge – they are being asked to increase their business footprint by 5-10 times in a 7-year period. At present, there is little desire to share this capital and commercial risk of building new mines or expanding their business to meet this new demand.

Major auto manufacturers will eventually have to conclude that supply chain partnerships and capital investment is the only way to secure lithium, graphite, cobalt, nickel or lithium ion battery cells. But this decision-making process is slow for players outside of China and risks derailing any form of revolution in the energy storage industry.”

He argued that necessary investment is still falling short and “needs to be 10 times larger to create a new blueprint for a post-2030 world.”

Concluded Moores:

“This energy storage revolution is global and unstoppable. For countries and corporations, positioning themselves accordingly to take advantage of this should be of paramount importance and longer term (~10 year) decisions need to be made.”

Here’s hoping that his testimony resonates with Members of Congress and helps deepen the conversation about a much needed comprehensive mineral resource strategy.

To read Moores’s full testimony, click here. Video footage of the hearing will be made available on the committee’s website as well.