You may have caught Elon Musk’s exchange with Daimler on Twitter over investment in EV technology earlier this week. Vacuum giant Dyson has also tossed its hat into the ring announcing that it will spend $2.7 billion to develop an electric car.

You may have caught Elon Musk’s exchange with Daimler on Twitter over investment in EV technology earlier this week. Vacuum giant Dyson has also tossed its hat into the ring announcing that it will spend $2.7 billion to develop an electric car.

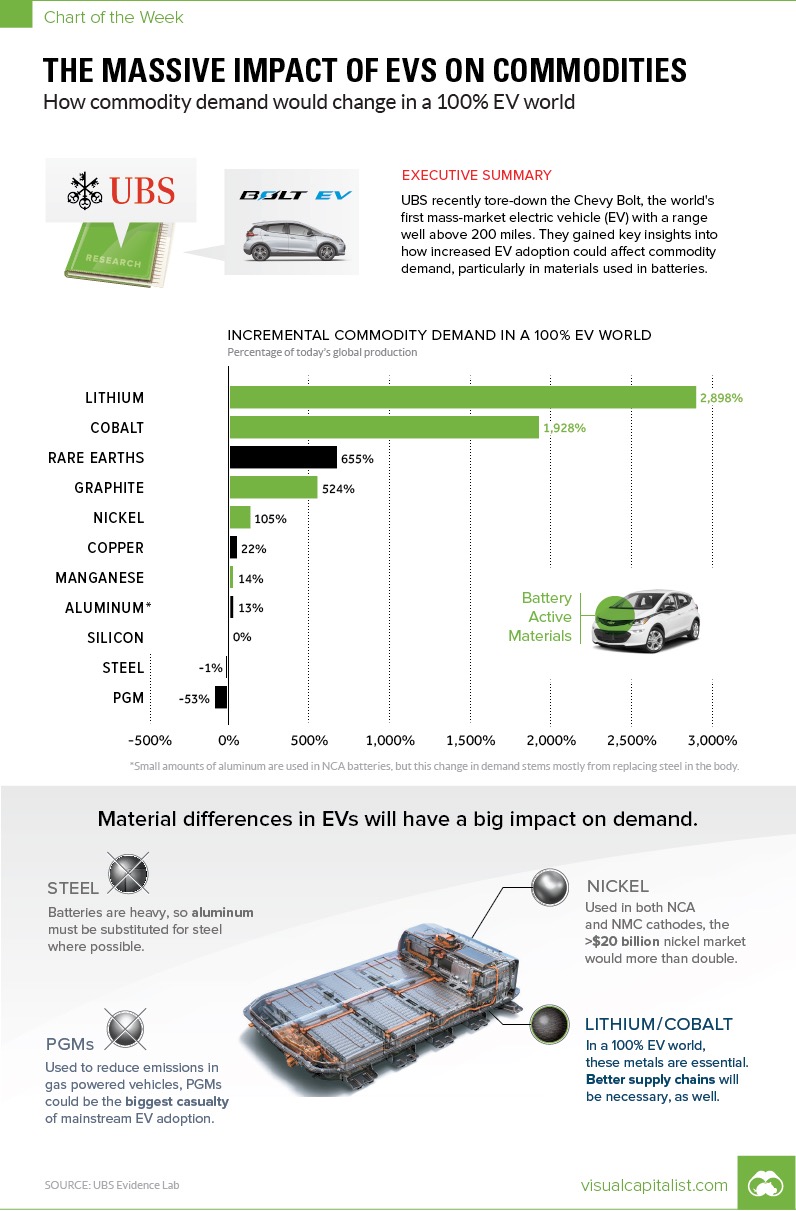

The headlines are piling up, and it’s no longer a secret that demand for electric vehicle technology is surging. Undoubtedly, EV technology has transformative effects on commodities – but what exactly are we looking at?

Visual Capitalist, which often features fascinating infographics, has attempted to capture “the massive impact on EVs on commodities in one chart.” One should note that the chart is based on a thought experiment – a potential scenario in which 100% of global auto demand came form Chevy Bolts – which at this point sounds far-fetched. However, with Visual Capitalist cites a recent projection put EVs at a 16% penetration by 2030 and then 51% by 2040, it’s a potential scenario worth considering.

Take a look at a large version of the infographic and the corresponding article here.

The outlined implications of a flip of global demand to the outlined 100% demand scenario are staggering:

Source: http://www.visualcapitalist.com/massive-impact-evs-commodities/

Source: http://www.visualcapitalist.com/massive-impact-evs-commodities/

If you are interested in more background information on EV battery technology, and supply and demand scenarios, our friends at Benchmark Mineral Intelligence are putting on yet another great event in October, entitled “Cathodes 2017 – the battery market’s only dedicated cathode conference, from raw material to end market.”

Hosted from October 8-10 in California’s Newport Beach, the event brings together experts and stakeholders for “3 days of presentations, workshops and networking events all dedicated to examining the present and future of the cathode industry.”

Check it out – it will be worth your time.