As lawmakers on Capitol Hill are scrambling to finalize major federal spending legislation set to include several key provisions relating to natural resources, a recent Wall Street Journal piece on wind power underscores the urgency of our nation’s looming raw material shortfalls.

Against the backdrop of surging demand in the context of the green energy transition, wind turbine makers, all of whom lost some of the “wind in their sails” in 2021 amidst the ongoing coronavirus pandemic, are increasingly facing rising commodity prices.

Writes WSJ’s aRochelle Toplensky:

“Commodities such as steel, polymers, copper and rare earth elements make up about 19% of the total cost of onshore turbines and 13% of offshore ones, according to analysts at Bernstein. The price of steel—the most significant raw material—has nearly doubled this year.”

It’s a sign of what’s to come as nations continue their accelerated push towards carbon neutrality. The mineral intensity of a low-carbon future has critical metals and minerals demand scenarios skyrocketing — and it’s not just battery materials (Lithium, Cobalt, Nickel and Graphite) and the Rare Earths, which appear to be grabbing all the headlines these days.

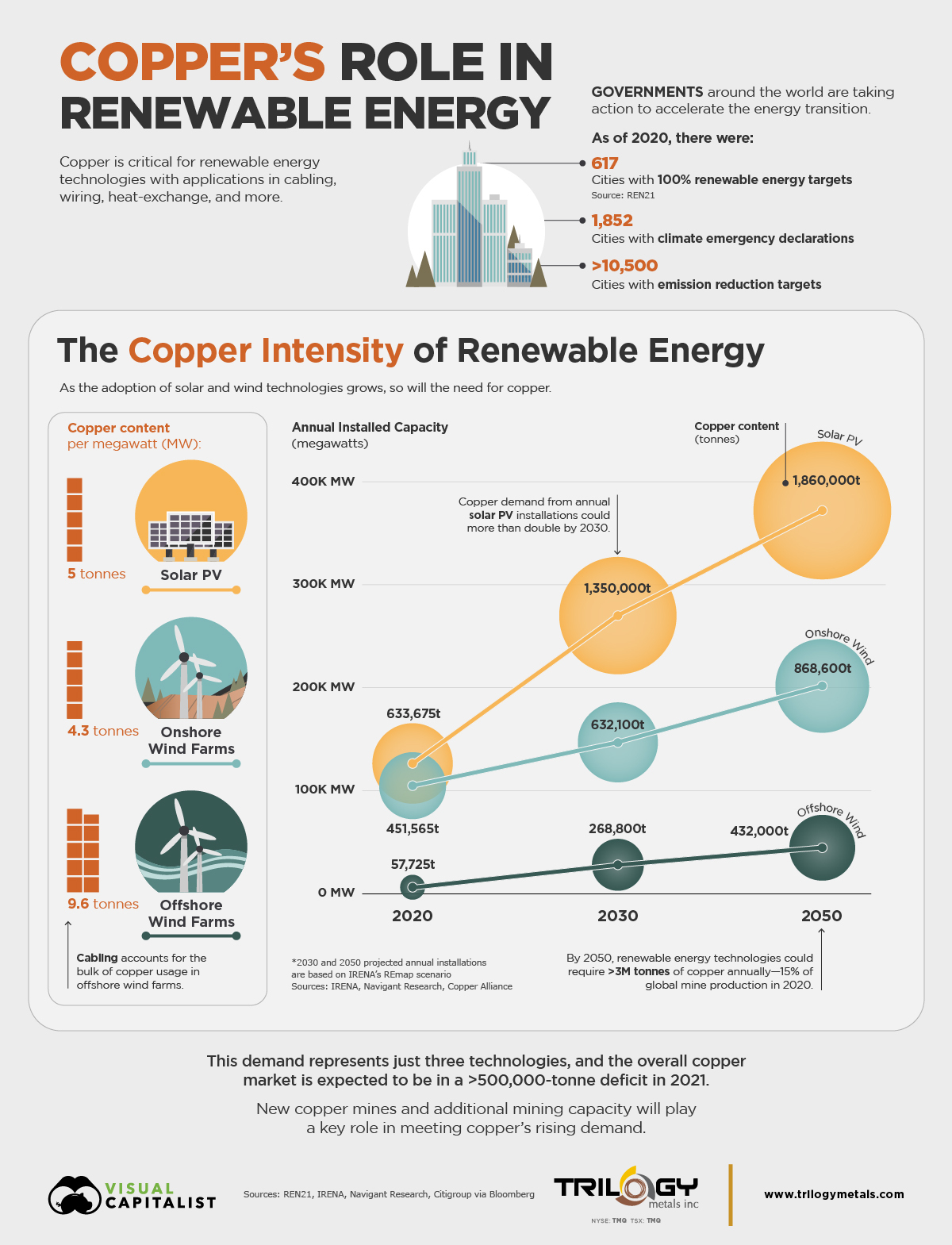

As we recently pointed out, Copper — may well be the unsung hero of the green energy transition — and is, quite possibly, one of the most “Critical Non-Criticals.” As we note in ARPN’s recent report, Critical Mass:

“Less flashy and headline-grabbing than some of its tech metal peers, this mainstay mineral deserves far more credit and attention than it is currently getting. Followers of ARPN will know that we have long touted the versatility, stemming from its traditional uses, new applications and Gateway Metal status.

Copper is also an irreplaceable component for advanced energy technology, ranging from EVs over wind turbines and solar panels to the electric grid. The manufacturing process for EVs requires four times more Copper than gas powered vehicles, and the expansion of electricity networks will lead to more than doubled Copper demand for grid lines, according to the IEA.”

We featured a recent graphic by Visual Capitalist depicting the Copper intensity of the energy transition with a view towards solar and onshore and offshore wind energy technology:

Current developments in Washington, D.C., including some of the spending provisions contained in the reconciliation and infrastructure packages, as well as announcements of new EV goals and fuel efficiency standards — will only add to the critical material demand scenarios. Rising prices for wind-critical materials like Copper, REEs and steel are just one indicator that the only way to moderate the mineral intensity of the low-carbon future is to develop more sources of supply.