The Inflation Reduction Act (IRA), passed and enacted into law last year, is considered one of the landmark pieces of legislation to combat climate change and strengthen U.S. critical mineral supply chains.

The package included funding for tax credits and rebates for consumers buying electric vehicles, installing solar panels or making other energy-efficiency upgrades to their homes, including, a credit of $4,000 for lower-and middle-income individuals purchasing used EVs, and up to $7,500 tax credits for EVs. These represented a renewal of the existing $7,500 electric vehicle Federal tax credit starting in January of 2023, carrying it through until the end of 2032.

However – and of considerable interest for followers of ARPN — a new requirement is that qualified cars must be assembled in North America, and adhere to mandated “escalating levels of critical minerals to be sourced from the U.S. or a country with a free-trade agreement with the U.S.”

Said provision was hailed by some as key to addressing “emerging energy security vulnerabilities before they are intractable crises,” but the law’s vague terms left some of the United States’ partners scratching their heads wondering what these provisions meant for them.

A flurry of activity has followed, including the European Union’s response to the United States’ IRA in March of this year: the just-dropped Critical Raw Materials Act (CRMA) paired with sister legislation, the Net Zero Industry Act (NZIA), which aims to support investment in manufacturing capacity in ‘net zero emissions’ technologies in Europe.

(Read ARPN’s discussion of the EU’s response to the IRA here.)

Only days later, the United States Trade Representative Katherine Tai and Japan’s Ambassador to the United States, Tomita Koji, signed a critical minerals agreement (“Agreement Between the Government of Japan and the Government of the United States of America on Strengthening Critical Minerals Supply Chains”) which builds on the 2019 U.S.-Japan Trade Agreement and seeks to strengthen and diversify critical minerals supply chains and promote the adoption of electric vehicle battery technologies.

According to the Biden Administration, “in particular, the Agreement memorializes the shared commitment of the United States and Japan with respect to the critical minerals sector to facilitate trade, promote fair competition and market-oriented conditions for trade in critical minerals, advance robust labor and environmental standards, and cooperate in efforts to ensure secure, transparent, sustainable, and equitable critical minerals supply chains.”

Observers believe that the trade agreement may allow Japanese companies greater access to the Inflation Reduction Act’s clean vehicle credit.

Write lawyers Thomas G. Allen, Stephen M. Anstey and Kurtis G. Anderson in an Insights Alert for international law firm Kilpatrick Townsend:

“While the United States has established comprehensive free trade agreements with over twenty countries, Japan is not one of them. This has left Japan (a critical U.S. ally and the second largest democratic economy in the world) and its companies ineligible to benefit from valuable IRA tax incentives. The new trade agreement on critical minerals may change that.

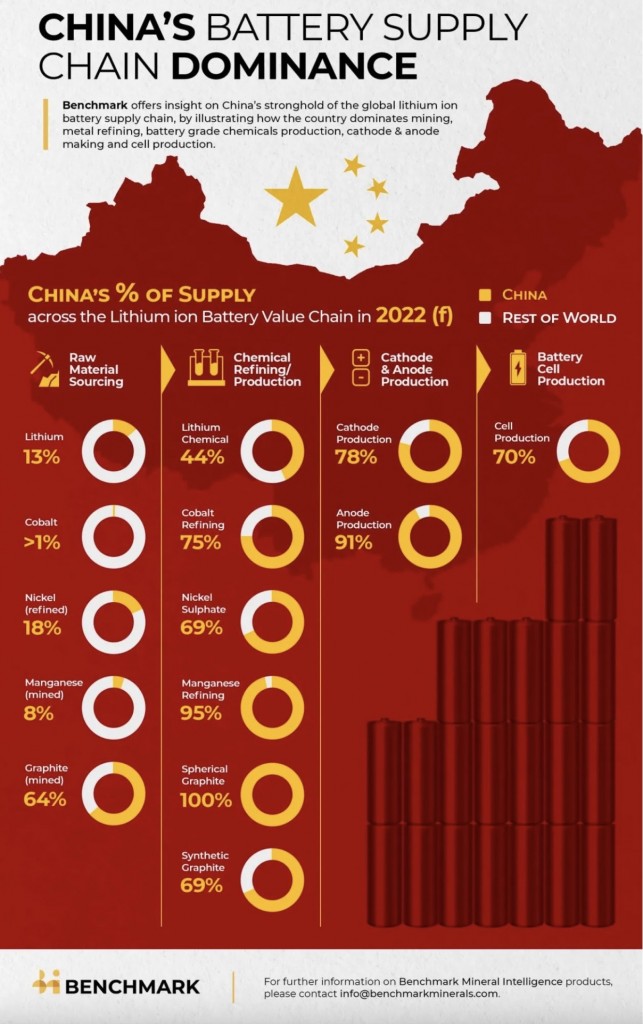

The IRA does not define several key terms concerning tax credits, including what constitutes a ‘free trade agreement.’ The Biden Administration hopes that this new self-styled free trade agreement on critical minerals will suffice. The free trade agreement is specifically tailored to create eligibility, explicitly circumventing ‘prohibitions or restrictions on imports of critical minerals,’ including lithium, graphite, manganese, cobalt, and nickel, from and between the two countries.”

Allen, Anstey and Anderson suggest that if this strategy is successful, the Biden Administration would use this tailored trade deal as a template for ongoing negotiations with the European Union currently excluded on the same basis from the benefits of the clean vehicle credit, and news reports seemed to confirm this suggestion.

With the Department of the Treasury and the Internal Revenue Service having released new guidance to clarify how manufacturers may satisfy the critical mineral and battery component requirements of the IRS’s clean vehicle tax credit on March 31, negotiators may have received more clarity and be able to reach agreement soon.

Treasury’s Notice of Proposed Rulemaking (NPRM) proposes:

“a three-step process for determining the percentage of the value of the critical minerals in a battery that contribute toward meeting critical minerals requirement: 1) determine procurement chains, 2) identify qualifying critical minerals, and 3) calculate qualifying critical mineral content.

a set of principles for identifying the set of countries with which the United States has a free trade agreement in effect, since this term is not defined in statute. This term could include newly negotiated critical minerals agreements.”

These agreements, according to the proposed notice which is filed for public inspection and will be published in the Federal Register on April 17, 2023, “would be considered based on whether they reduce or eliminate trade barriers on a preferential basis, commit the parties to refrain from imposing new trade barriers, establish high-standard disciplines in key areas affecting trade, and reduce or eliminate restrictions on exports or commit the parties to refrain from imposing such restrictions on exports, including for trade in the critical minerals contained in electric vehicle batteries.”

The IRS has announced that an updated list of electric vehicles that qualify for the tax credit after April 17, will be available on April 18.

But while tax guidance can clarify, it can also sharpen points of contention. U.S. Senator Joe Manchin has expressed his displeasure with the proposed notice arguing that ignores “the purpose of the law which is to bring manufacturing back to America and ensure we have reliable and secure supply chains,” and has threatened legal action against Treasury.

ARPN will be following the developments surrounding the proposed notice and related trade negotiations closely. Consider it a sign of the rising importance of Critical Minerals: Tax, trade and investment policies are being mobilized to incentivize Critical Mineral development. ARPN will watch closely for progress as well as unintended consequences as these policies take shape.