The Biden Administration made clear early on that it is committed to pursuing a low-carbon energy future, and battery technology is a key driver underpinning the shift away from fossil fuels. Just a few weeks ago, when touting his infrastructure package at Ford’s electric vehicle plant in Dearborn, President Joe Biden declared: “The future of the auto industry is electric. There’s no turning back.”

Thus, it came as no surprise that President Biden’s February 2021 executive order launching a 100-day review of supply chain vulnerabilities for four key products targeted advanced batteries. The Department of Energy has now completed its review, with the findings released last week as part of a comprehensive 100-Day Supply Chain Report.

As DoE points out:

“Advanced, high-capacity batteries play an integral role in 21st-century technologies that are critical to the clean energy transition and national security capabilities around the world—from electric vehicles, to stationary energy storage, to defense applications. Demand for these products is set to grow as supply chain constraints, geopolitical and economic competition, and other vulnerabilities are increasing as well.”

In its report chapter, DoE notes that

“The rationale for supporting the U.S. supply chain now is clear: demand for EVs and energy storage is increasing, investors are increasing investment in the clean economy, and the pandemic has underscored the fragility of some U.S. supply chains. China and the European Union (EU) – in contrast to the U.S. approach – have developed and deployed ambitious government-led industrial policies that are supporting their success across the battery supply chain. China has also moved beyond conventional policy support with practices involving questionable environmental policies, price distortion through state-run enterprises to minimize competition, and large subsidies throughout the battery supply chain.”

In other words, as ARPN expert panel member and Benchmark Mineral Intelligence managing director Simon Moores told members of Congress a while back:

“We are in the midst of a global battery arms race.”

Moores had told members of Congress that “[i]t is not too late for the US [to secure global supply chains post-COVID] but action is needed now.” — a sentiment DoE echoes in its report chapter:

“However, the opportunity for the United States to secure a leading position in the global battery market is still within reach if the Federal Government takes swift and coordinated action.”

While less explicit about the “all of the above” approach than the Department of Defense, DoE notes that:

“With the global lithium battery market expected to grow by a factor of five to ten by 2030, it is imperative that the United States invests immediately in scaling up a secure, diversified supply chain for high-capacity batteries here at home. That means seizing a critical opportunity to increase domestic battery manufacturing while investing to scale the full lithium battery supply chain, including the sustainable sourcing and processing of the critical minerals used in battery production all the way through to end-of-life battery collection and recycling.

Through strong collaboration across the federal government, with U.S. industrial stakeholders, the research community, and international allies, the U.S. must develop a durable strategy that invests and scales our potential industrial strengths to meet this challenge.”

Among the Agency’s key recommendations for immediate and future action to strengthen the domestic advanced battery supply chain are:

- Strengthening U.S. manufacturing requirements in federally-funded grants, cooperative agreements, and research and development (R&D) contracts.

- Procuring stationary battery storage.

- Providing financing to the advanced battery supply chain for electric vehicles.

- Releasing the National Blueprint for Lithium Batteries by the Federal Consortium on Advanced Batteries (FCAB).

- For Congress to catalyze private capital with new federal grant programs to support battery cell and pack manufacturing.

- The electrification of the nation’s school bus fleet, and the acceleration of the electrification of the nation’s transit bus fleet.

- Providing consumer rebates and tax incentives to spur consumer adoption of EVs.

- Investing in the production of high-capacity batteries and products that use these batteries to support good-paying, union jobs.

Developing strong environmental review permitting practices for the extraction of critical minerals.

Under the sub-head “Mapping the Supply Chain,” while the Department zeroed in on the usual suspects — notably Lithium, Cobalt, Graphite, Manganese — all of which were officially deemed critical on the U.S. Government’s official 2018 Critical Minerals list — DoE also prominently features Nickel and Copper. For Nickel, DoE even notes that “if there are opportunities for the U.S. to target one part of the battery supply chain, this would likely be the most critical to provide short- and medium-term supply chain stability.”

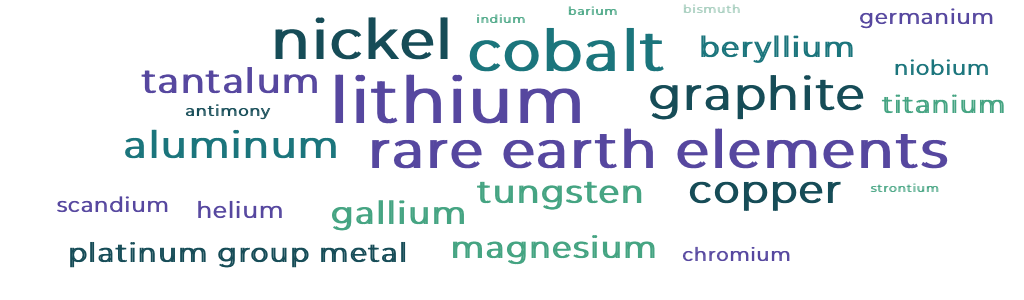

Which would make Nickel the most critical “non-Critical” – a status consistent with the word cloud we created based on the number of 100-Day Report mentions (footnotes included) of the metals and minerals that made the official U.S. Government Critical Minerals List of 2018 — and the two that didn’t but should have (Nickel and Copper).

As we noted in our post earlier this week, the Biden Administration is right to give prominence to Nickel and Copper in its strategy.

After all, as Reuters’s Andy Home has pointed out,

“There is no domestic nickel processing capacity outside a limited amount of by-product salt production.

Yet this particular battery metal is the one likely to experience the most significant demand increase over the coming years, the report says, with ‘market indications that there could be a large shortage of Class 1 nickel in the next 3-7 years.’

Indeed, with nickel content rising in battery cathode design, not having enough of the right kind of nickel ‘poses a supply chain risk for battery manufacturing globally, not just in the United States.’”

And for Copper, the latest IEA report has estimated that — largely driven by the EV revolution — demand will be 25 times greater in 2040 than it was in 2020.

Thankfully, there are opportunities to alleviate our supply chain vulnerabilities and to begin the “sustainable sourcing and processing” here at home, both for Nickel and Copper, as well as for the other battery “Criticals,” and many other metals and minerals.

With the Administration having endorsed an “All of the Above” strategy to secure our supply chains “soup to nuts,” as Secretary of Energy Jennifer Granholm phrased it earlier this week, here’s hoping that this broad-based approach will find swift application via policy, programs and projects.