The Biden Administration has announced the “most aggressive” plan to curb tailpipe emissions to date, with new vehicle pollution standards proposed by the Environmental Protection Agency (EPA) and announced by the White House last week.

If finalized, the proposed rules would require automakers to reduce carbon emissions by 56% in their 2032 models compared to 2026 models. The expectation is that with the rules in place, 67% of new light-duty car purchases will be electric by 2032.

The move comes at a time when geopolitical and trade tensions between the United States and our allies on one hand, and China on the other are soaring, and observers argue that the ambitious plans could play into Beijing’s hands.

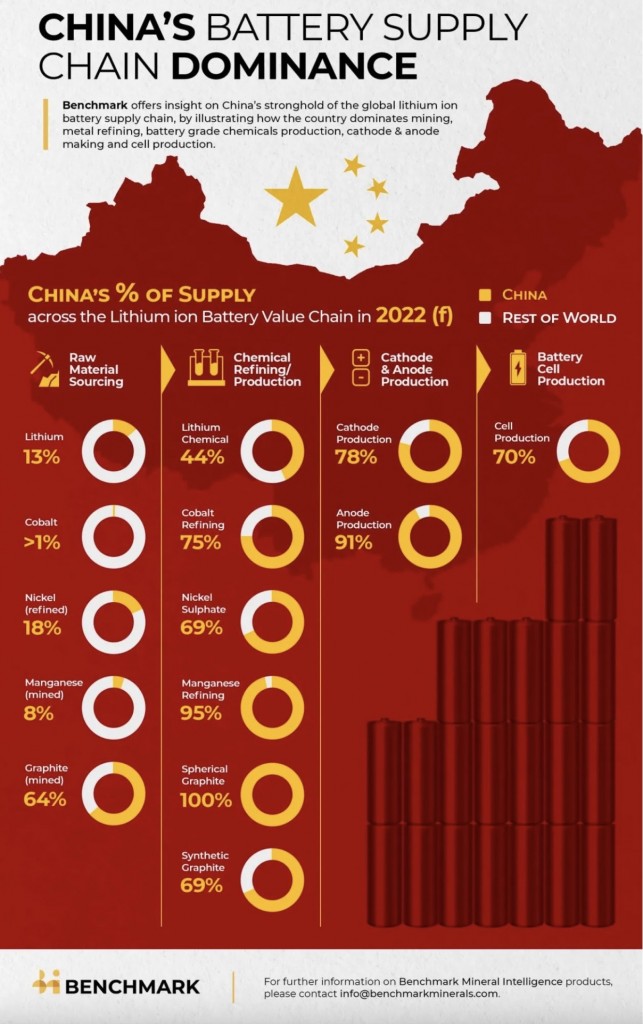

While the United States has taken several important steps to decouple its critical mineral supply chains from China, Beijing, having systematically built out its dominance across the entire value chain from mining over processing to manufacturing, still has a chokehold on the EV battery supply chain, and the latest USGS Mineral Commodity Summaries report confirmed that for all of the recent U.S. policy efforts, our dependencies still persist.

In case anyone needed a reminder, here is an infographic from last November, compiled by our friends at Benchmark Mineral Intelligence clearly visualizing China’s dominance of the battery supply chain.

The Biden Administration has, in recent weeks, stepped up its friend-shoring initiatives to bolster U.S. supply chains, with recent trade deliberations having yielded a free trade Critical Minerals agreement with Tokyo and a likely similar accord between the U.S. and EU. U.S.-Canadian critical minerals cooperation has also seen a boost.

Embedded into a comprehensive “All of the Above” strategy, these friend-shoring initiatives can play an important role in strengthening critical mineral supply chains. And yet there are mounting concerns that the Biden Administration, in spite of verbal affirmations of wanting to responsibly expand domestic resource development and processing, continues to cater to the “not-in-my-backyard” sentiment, which still runs strong in discussions on resource development.

This brings us back to the “inherent irony” or “paradox of the green revolution” Reuters columnist Andy Home has invoked in several instances when covering critical mineral resource supply chains for the very materials underpinning the green energy transition — the paradox that “public opinion is firmly in favour of decarbonisation but not the mines and smelters needed to get there.”

It’s not that there is a lack of promising domestic resource development projects, especially for the Battery Criticals — lithium, cobalt, graphite, nickel, and manganese.

ARPN recently looked at each of these materials, now deemed under President Biden’s DPA determination to be “essential to the national defense,” and the U.S.-based projects working to urgently needed new supply into production. [See our discussions linked here: Lithium, Cobalt, Graphite, Nickel, Manganese]

And let’s not forget copper, which has increasingly been recognized – most recently by the EU — as a critical raw material in light of its key role in the green energy transition, and for which a push to have the metal added to the U.S. Government Critical Minerals List is currently underway.

As ARPN has previously pointed out, lofty goals of net carbon neutrality – and that includes the just released proposed EPA emission standards – will not be achievable if we don’t embrace a push to secure critical mineral supply chains from “soup to nuts” to borrow a term used by Energy Secretary Jennifer Granholm.

After all, as we’ve noted often at ARPN, the first word in supply chain is… supply.