As the electrification of the global vehicle fleet continues to gain steam, Ford Motor Co.’s president and CEO Jim Farley recently made some comments during a live-streamed interview with the director of Detroit Homecoming VIII Mary Kramer that should give policy makers some food for thought.

Expressing his concerns about the affordability of electric vehicles for the average vehicle buyer against the backdrop of rising raw material costs and supply chain challenges, Farley alluded to the challenges associated with the “Not in My Backyard” mentality. He said to provide affordable solutions for the broad customer base,

“[w]e have to bring battery production here, but the supply chain has to go all the way to the mines. That’s where the real cost is and people in the U.S. don’t want mining in their neighborhoods.”

It’s a classic example of what a recent Financial Times story called the “Green Dilemma” — to meet soaring demand and develop supply chains that are not reliant on adversary nations, both new domestic mining and processing capabilities should be boosted, but, as one mining executive quoted in the FT piece put it, while domestic —responsible — mining would be preferable to outsourcing it to China, “[e]nvironmentalists want to have their cake and eat it. They want these materials for the EV sector — but if they’re causing environmental devastation [in China], then how are you going to put them into green technologies?”

Farley did not mince words when he asked:

“So are we going to import lithium and pull cobalt from nation-states that have child labor and all sorts of corruption or all we going to get serious about mining? … We have to solve these things and we don’t have much time.”

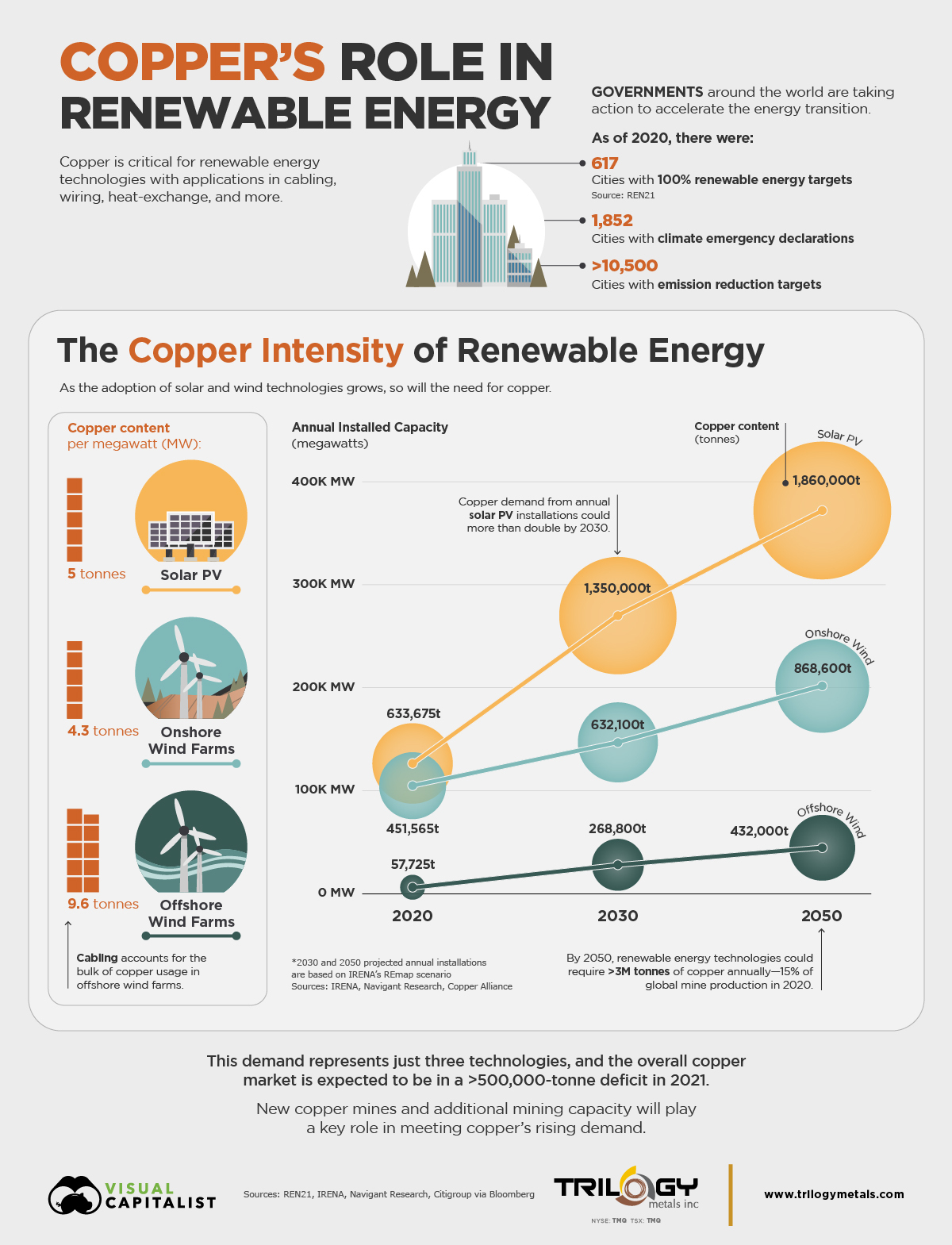

Farley is correct. Demand scenarios for battery tech materials are rising astronomically.

But — the good news is that, as we have previously argued, the mining industry “[is] already actively working to meet the increased expectations of consumers, society and governments” to contribute towards the push towards a greener energy future — not just at the mining, but also at the processing stage.

The industry has increasingly been harnessing advances in materials science and technology to meet the challenge of developing a domestic critical minerals supply chain while maintaining and advancing responsible mining and processing practices — examples of which can be found here.

As we have previously stated:

“Recent studies — we featured the latest IEA study here — and policy experts agree: against the mounting pressures of the 21st Century Tech Metals Age, keeping it all in the ground is too simplistic, and a holistic ‘all of the above’ approach to energy and critical minerals is the only viable path to success.”

Hopefully policy makers in Washington, D.C. are listening to Farley’s hot take from Detroit.